Broad framing as a strategic contextualizing tool on agriculture

This is the sort of engagement Throughline offers in our Broad Framing Initiative

You see a chart like this from Visual Capitalist:

And you say to yourself, Man! China and India rule on wheat, right?

Except they don’t.

With food, there’s always this simple equation:

Take what you produce

Add what you import

Subtract what you eat, and

What’s left over can be exported.

China and India are huge producers, but China just surpassed food-insecure Egypt as the top importer of wheat.

You want to know why Chinese firms are seeking farmland leases and purchases across the globe? That is why.

So, when we look at the list of top exporters of wheat …

China and India are nowhere to be found (okay, you can find, with some squinting). Instead, we see that Russia is the top exporter, followed by the Americas (Canada, US, Argentina in the lead).

The European share here is misleading, because they — like in almost all things — largely export to one another within the EU — a huge market like the US itself. That’s what makes the US ability to export so much that much more impressive: we eat a lot and we still have tons (literally) left over.

Another thing to note: the combo of Russia and Ukraine is big-time, on par with the US and Canada, so a war between the two is deeply unsettling to global markets. [Imagine the wheat market if the US and Canada were to mix it up.]

Ukrainian production is down by one-third since the war began, with exports down by one-half — seemingly on a permanent basis.

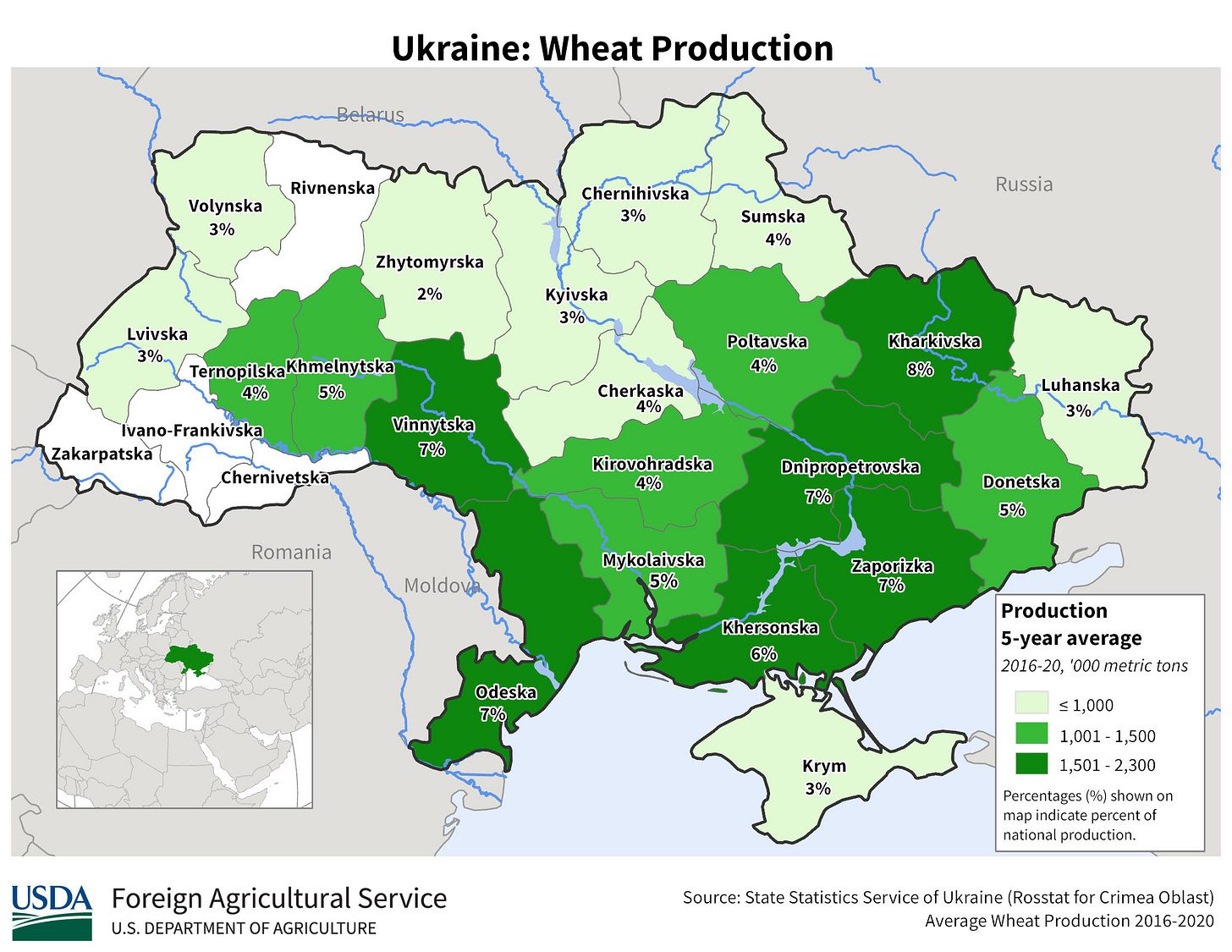

Take a look at where Russia is grabbing micro-states from Ukraine and you spot a lot of its wheat production:

Russian micro-state created to date include:

Kherson (2022)

Zaprorozhye (2022)

Lugansk (2014)

Donetsk (2014)

Crimea (2014).

Russia’s exports of wheat have not suffered any long-term damage. Indeed, they hit a new peak last year.

Pulling back the lens further: why does wheat matter so much? It provides approximately 1/6th of the world’s caloric intake, roughly the same as rice.

What’s number one? That would be corn at 1/5th. On corn, the biggest exporters are all in the Americas (US #1, Argentina #2, Brazil #3).

But, for even more complexity, let’s add in climate change. A good example: expanded corn production in Brazil leads to deforestation of the Amazon, which raises local temps, which depresses Brazil’s yield in a negative doo-loop.

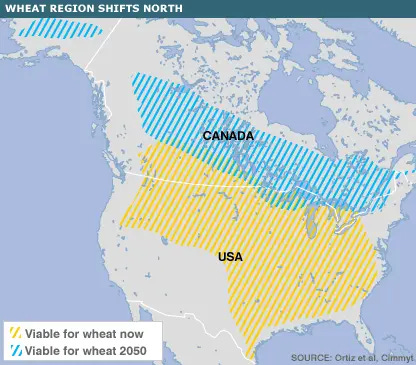

But, back to wheat. In the Americas, for example, we now grow wheat as northward as the 55th parallel in Canada. By mid-century, the estimate is that that wheat belt will extend another 700 or so miles northward to the 65th parallel. That is some serious change to factor in, right?

One NASA projection actually suggests an overall curtailment of North America’s wheat-production area by half by mid-century, while another NASA study suggests a potential expansion of overall production of wheat and a contraction of far-more thirsty corn.

Rice, another 1/6th of the world’s caloric intake, is overwhelmingly produced and exported by Asia. India is the top exporter, so, whenever New Delhi gets spooked about food security and bans exports, rice prices jump.

All in all, a complex, very dynamic picture, right?

Add all these grains up and you get this picture of imports and exports from America’s New Map:

If your export “half-moon” is larger than your import half-moon, then you can feed others. Conversely, if you’re East Asia or Southeast Asia or the Middle East or Sub-Saharan Africa, then you need a functioning global grain market.

We all know the story of how revolutions start, the best predictor being the local price for, and availability of, bread.

Getting all these big pictures down in your head is immensely empowering as you read the news, operate relevant companies, and think strategically about where all this is going.

Throughline and I made that kind of effort in January with the Dairy Board Association in Green Bay.

I wrote about the engagement (150 or so farmers “representing” hundreds of thousands of dairy cattle) here.

We’re presently booking, or are in discussions with, various industry associations to the do the same in coming months.

The day after tomorrow, I’m remotely briefing 50 CEOs from India’s biggest companies, with whom we’re looking to create similar engagements.

If you think your company/industry/association would be interested in this sort of broad-framing the future, please reach me at tbarnett@throughline.com