The CNBC headline blares:

Southeast Asia is a top choice for firms diversifying supply chains amid U.S.-China tensions

Is this the much-described “China plus one” corporate strategy at work?

The “China Plus One” strategy seeks to reduce the risks associated with total reliance on China’s market or supply chain through diversifying manufacturing operations, expanding into other countries even as companies’ maintain a presence in China.

The deuce, you say!

Is this all part of the White House’s supply-chain de-coupling from China?

Could this be yet another front in Washington’s various economic “wars” with Beijing? Nationalism run amok? Protectionism gone mad? The lingering effects of Trump’s “America First” tariffs?

When did trade get so politicized and strategic?

I feel like I should be both proud and afraid. Surely, this is politics encroaching on trade!

Chaos, I tell you!

Or maybe all those grandiose explanations are superficial icing on a cake at once far more deterministic and banal.

The logic I spot here is simple and immutable: go where the cheap labor is presently concentrated.

From America’s New Map:

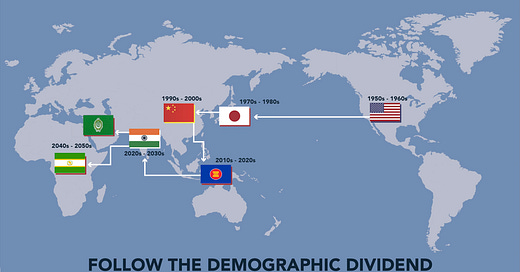

My secret history of globalization … America escaped World War II demographically and industrially unharmed, only to immediately enjoy a baby boom that allowed it to capitalize on its supremely advantageous position as sole surviving economic superpower. America was indeed great but sought to share that greatness with others, engineering the economic resurrection of former enemies (Japan, Italy, Germany) and encouraging Western Europe’s cloning of its integrating political union (the EU).

Taking advantage of America’s largesse, Japan’s three-decades-long post- war demographic boom fueled its amazing industrial rise while preordaining its rapid aging. Tokyo and its imitators, known as the Four Asian Tigers (South Korea, Singapore, Hong Kong, and Taiwan), were too successful for China to ignore, particularly as the Soviet Union’s rapid dissolution confirmed the economic backwardness of state socialism.

China’s own demographic dividend (1980–2010) followed closely on Japan’s heels, only to peak during the Great Recession. Not only have factory wages risen ever since but now Beijing also faces a loss of 200 million workers by 2050.

Fortunately for China, globalization’s next great pool of cheap labor emerged next door in Southeast Asia, to which Beijing is already directing its lower-end manufacturing assets and investments in increasing competition with Japan and India. But Southeast Asia’s own rapid aging is well underway, compressing its demographic margins and marking it as mere placeholder for its far-larger successor: India, with its youth bulge of half a billion souls. India’s demographic dividend will peak in the 2035–2040 time frame, subsequently yielding to similar dynamics in both the Middle East and Africa, which in combination will offer up a dividend approaching one billion workers.

This is what’s really going on.

Keep reading with a 7-day free trial

Subscribe to Thomas P.M. Barnett’s Global Throughlines to keep reading this post and get 7 days of free access to the full post archives.