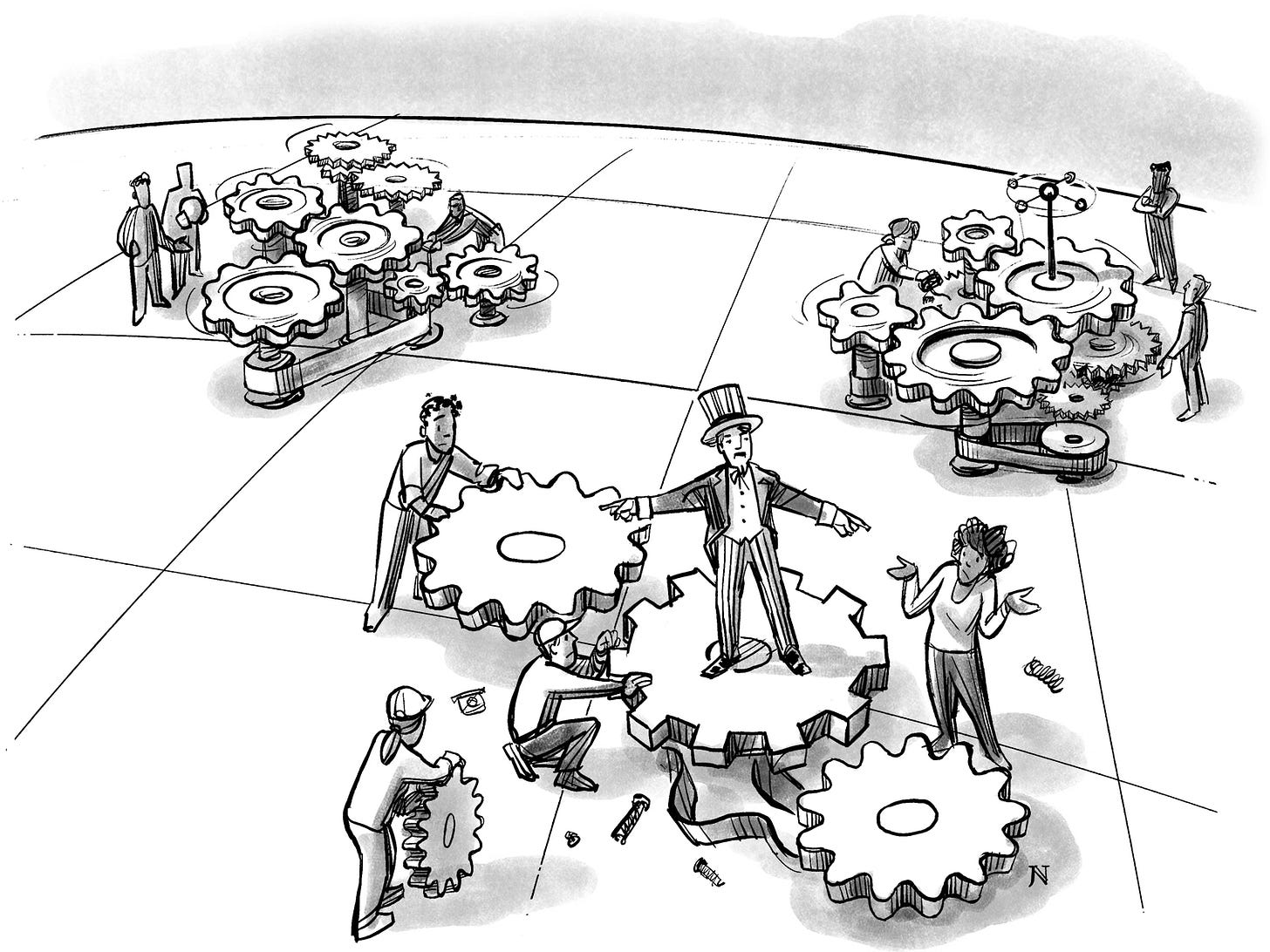

Organized versus unorganized economic regions

Connectivity and integration as indicated by intra-regional trade

More stuff I am working out mentally as I frame out a follow-on MOOC (massive open online course) to my existing one (Superpower Grand Strategies: Winning the Globalization Game), this time looking at intra-regional trade (as a percent of total trade) as an indicator of overall value-chain integration in the global economy (something I cited in my book but did not delve much into).

The idea is simple enough: the higher your intra-regional trade integration is, the more your economy and those of your neighbors have worked out — proximity-wise — the most logical and efficient value chains (going no farther than you need to access inputs at reasonable prices and keeping the distance between production and consumption as short as possible for just-in-time reasons and because it’s good politics [Your Honda is American made!]).

More generally, a high level of intra-regional trade indicates a strong degree of economic integration and interdependence among the countries within that geographic region, featuring such things as

Larger integrated regional market that allows economies of scale and lower costs through increased competition

Regionalized value chains that feature more value-added products and capital goods rather than just raw materials

Reduced trade barriers

More efficient trade logistics

Harmonized trade regulations

Improved infrastructure connectivity

Fewer non-tariff barriers

Economic complementarities

Higher levels of intra-industry trade and economic diversification away from just natural resources.

In sum, a high and rising intra-regional trade share signals the creation of an integrated economic space with liberalized market access, advanced production networks, smoother trade facilitation, and economic restructuring among individual national economies to facilitate all of the above — all of these are economic wins for the countries involved.

That’s the good stuff.

The harder stuff is that such an organized and integrated economic space makes it more difficult for outsiders to break into that universe, in large part because what they can corner as a share of that market tends to remain rather insignificant, thus limiting their ability to influence rule-making within that sphere.

Say your country has a 50% share of a regional market. Sounds like you dominate, right? Like your voice would be heard in national capitols because your country is involved with 50% of the combined extra-regional exports and imports going out of, and into, this regional market.

But what if this regional market conducts three quarters of its trade intra-regionally?

Now, your 50% share of its collective external trade is reduced to more like 12% of that region’s total trade.

Well, when you add up America’s economic activity as a continental political union, you find that intra- and inter-state trade within our country accounts for about 75% of the total, leaving only about a quarter of our economic activity subject to foreign trade.

And, if 40% of that trade is concentrated intra-regionally within North America (reflecting the US, Mexico, Canada Agreement [USMCA] that replaced NAFTA [North American Free Trade Agreement]), then that 25% exposure to trade is reduced to just 15% beyond our continent.

Keep reading with a 7-day free trial

Subscribe to Thomas P.M. Barnett’s Global Throughlines to keep reading this post and get 7 days of free access to the full post archives.