This is a reader-supported publication. I give it all away for free but could really use your support if you want me to keep doing this.

First, some broad framing from Great Powers: America and the World After Bush (2009) and totally borrowing from a great historian:

But the post-Civil War long boom — punctuated by nasty busts, mind you — was also a clear tipping point in our journey from states uniting to the United States. In the metaphor Thomas Friedman uses to explain modern globalization, America was leaving behind the “olive tree” world that focused on blood ties, the land, and sectionalism, and began moving toward modernity, or the “Lexus” world of increasingly high-tech production and international commerce. As historian Edmund Morris notes, “America was no longer a patchwork of small self-sufficient communities,” but “a great grid of monopolistic cities doing concentrated business with one another: steel cities and rubber cities, cities of salt and cloth and corn and copper.” The United States was the rising China of the age, zooming up to and — in many categories — zooming past our model, Great Britain. If you think Americans use Chinese products to the exclusion of all else now, the same realization was dawning on the British regarding America at the beginning of the twentieth century. Consider this account from Morris:

“Current advertisements in British magazines gave the impression that the typical Englishman woke to the ring of an Ingersoll alarm, shaved with a Gilette razor, combed his hair with Vaseline tonic, buttoned his Arrow shirt, hurried downstairs for Quaker Oats, California figs, and Maxwell House coffee, commuted in a Westinghouse tram (body by Fisher), rose to his office in an Otis elevator, and worked all day with his Waterman pen under the efficient glare of Edison light bulbs.”

Could America be stopped at that point in its rise?

No, it could not.

Now consider this NYTimes heavily-illustrated article on how much of our daily lives involve Chinese consumer products:

NYT: Your Home Without China

Some of the analysis and details:

America’s reliance on China is easy to see in your kitchen. China leads the global production of cheap goods made in large volume, such as dishes and cooking gadgets.

The United States also imports all of its household toasters, and nearly every one of them comes from China.

Over decades, Beijing has spent billions to support the growth of China’s manufacturing industry. Today, the country makes nearly one of every three physical products in the world — more than the United States, Germany, Japan, South Korea and Britain combined.

The U.S. has become so reliant on China that it would have trouble celebrating its own national holiday without it. The vast majority of fireworks are imported from China.

That’s just the product dependency. The list of economic interdependencies between China and the US is long:

The integration of global supply chains means US manufacturers rely on Chinese components (so-called intermediate goods) for electronics, machinery, and pharmaceuticals — to name just the biggest. Cut these flows off and a lot of US manufacturers won’t be able to switch suppliers fast enough or afford US alternatives (if they exist and they often don’t), certainly leading to near-term shortages and possibly triggering business failure if this tariff fight goes on and on.

Per the NYT story, China remains a dominant supplier of consumer goods, with e-commerce platforms like Shein and Temu. Even with Apple shifting production to India, 80% of iPhones sold in the US are still made in China.

Our military depends on Chinese suppliers for critical components in aircraft carriers, missiles, and other defense systems. Civilian technologies like AI, drones, and cloud computing have military applications, all of which complicate any effort to separate commercial and strategic sectors.

China is a major buyer of US agricultural products (soybeans and pork orders are presently cratering), semiconductors, and energy. That’s a lot of jobs put at risk, because bilateral trade still underpins key American industries.

While cross-border foreign direct investment has declined (Chinese FDI flows to US are now but a fraction of what they used to be), there’s all the legacy investments in joint ventures and stock markets in both directions.

The dollar’s role in global trade relies partly on China’s holdings of our debt, along with its willingness to use the dollar in international transactions — something Beijing is in the process of lessening in a defensive strategy.

Mexico and Southeast Asian countries (where the world’s demographic dividend is presently peaking) are value-chain intermediaries that assemble Chinese components into goods subsequently exported to us.

The more we reduce our reliance on Chinese and European imports, the more those other two demand/production hubs will turn to one another, meaning the West is just shifting one sort of dependence to another sort of dependence. US allies in Asia and Europe will resist fully aligning with either bloc, maintaining economic ties with both, meaning we cannot return to our own mini-globalization of advanced economies. Our allies simply lack our suicidal instincts. There is no more West to reconstitute, thanks to Trump.

Trump’s tariffs will cost American consumers and businesses plenty, while Chinese retaliatory tariffs hurt will damage our exporters. China can turn toward pushing more domestic consumption to make up the difference (not easy), but the same most definitely cannot be true for American exporters regarding already saturated US markets facing inflationary pressures.

We are interconnected in research and development. with bilateral academic and corporate partnerships in AI, clean energy, and biotech. Any extension of the Biden policy known as “small yard, high fence” is just going to further isolate us over time from global innovation,

Let’s not forget that China controls supplies of gallium, germanium, and graphite — all presently vital for our tech and defense industries. Replacing China as a supplier won’t happen overnight. Then there’s the people factor: Chinese engineers and researchers contribute to our tech firms, while US executives manage China-based operations. Narrowing such interactions will not benefit our innovation.

China’s consumer base is very important to Hollywood and firms like Apple and Tesla.

Finally, let’s not forget about Chinese holdings of US sovereign debt. Beijing is backing off US debt, bringing their holdings ($750B) down to its lowest level since the Great Recession. Still, China, along with Japan, remain critical to dollar liquidity and US borrowing costs.

What’s so crazy about this rapid-fire divorce is that it is not driven by any immediate US need.

With the help of Economist covers, let’s review the last year. Why cite an outside source? This is how those most friendly to our situation are now viewing our behavior, so consider this the most sympathetic source out there.

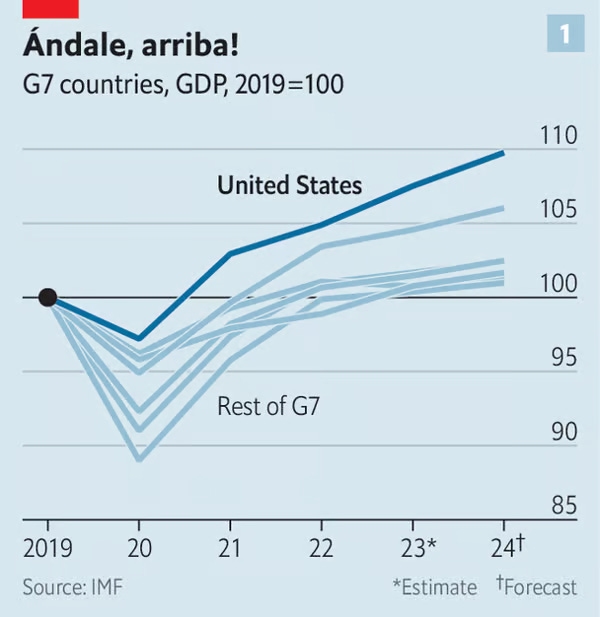

This is the US economy in March 2024.

This is the US economy in October 2024.

This is the data behind that assessment.

Trump gets elected.

Arriving out of the blue, Musk suddenly wants his money’s worth of fun-time with the US government.

January, with all the vibing about McKinley and tariffs and the implementation of Project 2025.

Trump’s Joker approach to the US economy is starting to scare people in early March.

Later in March, the extortion-like approach to allies — particularly Europe.

In early April, Liberation Day recast as Ruination Day for both America and the world.

Leading to this panicked cover in early April — Trump as the agent of chaos in all directions.

Then, this last week, this desperate sense of resignation and worry.

Again, this is all self-inflicted by one man.

If I was a supervillain capable of destroying the world, this is how I would do it — using Trump.

I keep saying to myself radical acceptance, radical acceptance, radical acceptance.

Today, it just doesn’t seem to be working.

The Economist has been doing great work trying to decipher, explain and warn about what is happening. Much more so than some other publications. Nice piece.