1) The countries we’ll ruin in our quest to be great

WAPO: Americans ordered up Donald Trump. The world will foot the bill.

Trump is applying to America-the-nation-rebuidling scenario that same “big bang/wrecking ball” logic that George W. Bush applied to our 2003 invasion of Iraq (as part of a larger strategy for the Middle East): I am done trying to fix this problem-set incrementally and would rather just blow it all up and see what comes next!

It is a strategy born of intense frustration, but it perfectly fits the mantra of you want it bad, you get it bad.

This is a brilliant op-ed by the always brilliant Eduardo Porter of WAPO. I so loved it that I sent him a copy of America’s New Map immediately upon reading it. He was grateful in reply.

The bit that really caught my eye:

Furious about inequality, voters have turned against globalization. And poorer countries will suffer.

Is that not one of my book’s many possible “nutshell” descriptions?

To a foreign observer, America’s quest for redress around the world is hard to understand. The United States is not only the most prosperous nation on Earth but also is pulling further ahead of its peers, growing faster than other affluent economies. Its gross domestic product per person is 35 percent higher than the average in the European Union, for instance. It is 63 percent bigger, after accounting for differences in the cost of living, than Japan’s. Few countries come near American levels of economic prosperity.

What’s more, the United States crafted most of the rules governing how the world economy runs. The World Trade Organization and the International Monetary Fund are largely of Washington’s own making. The United States shaped intellectual property law around the world. International capital markets hew to American norms.

The notion that the world has been unfair to the United States will strike your average non-American as … odd. Even the burst of globalization that, we were told, caused the upheaval of the White working class that put Donald Trump in the White House eight years ago was of Washington’s making, enabled in large part by its invitation of China to the WTO.

The United States, by the way, also handsomely profited from its liberal immigration policies of the past 50 years …

Right out of my book.

The fault lies not in globalization but in ourselves:

What ultimately motivates Trump’s voters is that the United States has done a dismal job of distributing the gains from these global wins. It is by far the most unequal nation in the developed world. The American poverty rate vastly exceeds that of other affluent nations. Its life expectancy is shorter than that of its peers. Its social ills belie its place among the group of “advanced” nations.

That’s not other countries’ fault, however. That’s the fault of a political system unwilling to address the social downsides of the many changes, whether technological, economic or demographic, that modernity has brought about, and distribute some of the gains from its winners to its losers.

Just consider government spending on what the Organization for Economic Cooperation and Development, a grouping of affluent industrial countries, calls social protection: redistributive programs targeted at vulnerable groups such as the elderly and the poor. In 2022, the average OECD country spent 15.76 percent of its gross domestic product on this item. The United States spent 8.04 percent.

The truth stings, does it not?

Brilliant single op-ed — truly. Porter always impresses the hell out of me, but my confirmation bias is showing here …

2) Will no one rid me of this turbulent globalization"?

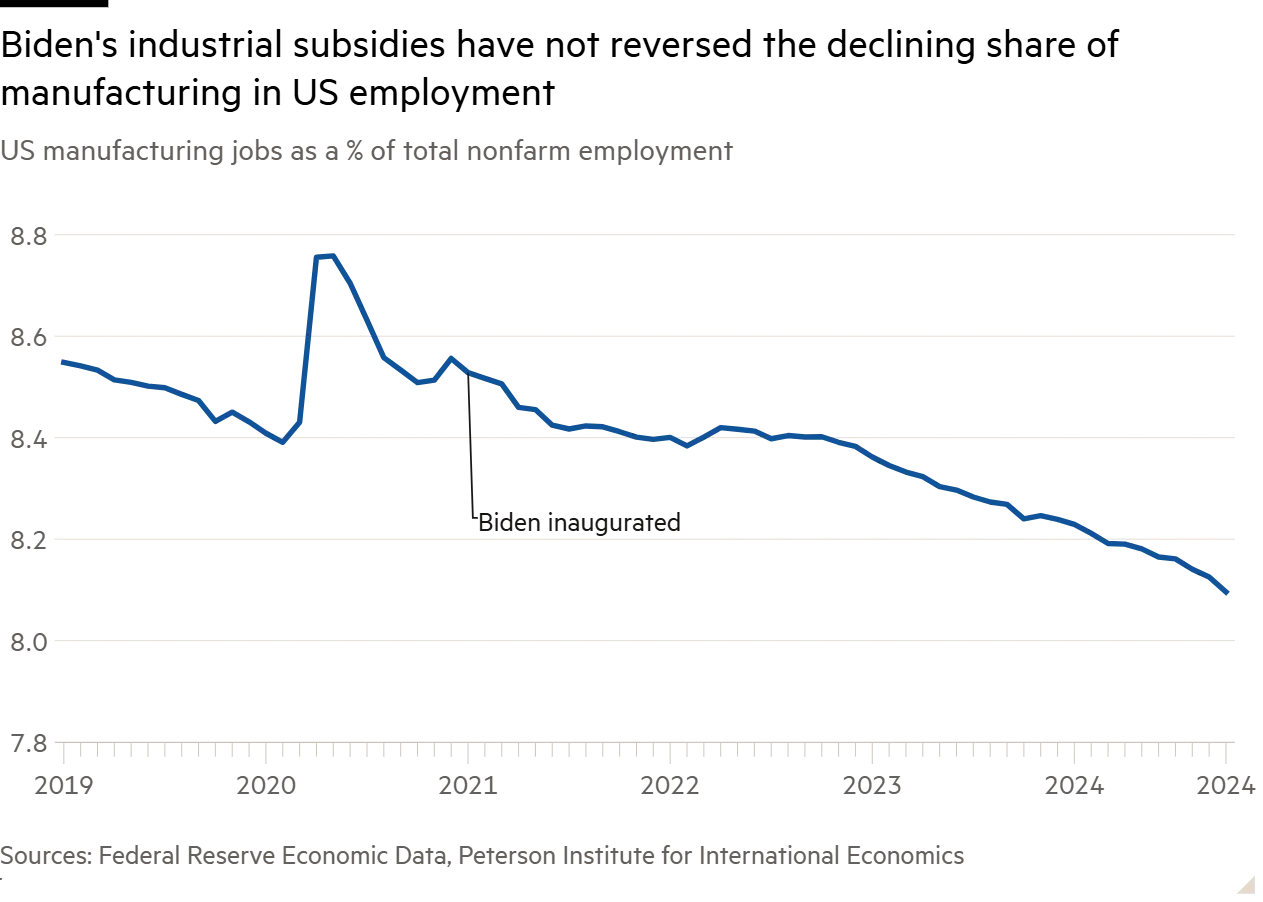

FT: Manufacturing fetishism is destined to fail

The also always brilliant Martin Wolf of the FT, whom I had the pleasure of meeting at a regional Davos WEF event years ago (Australia).

The harsh truth:

It is so much easier to blame the disappearance of these US jobs on China than on domestic consumers and automation.

The quick education:

In 1810, 81 per cent of the US labour force worked in agriculture, 3 per cent worked in manufacturing and 16 per cent worked in services. By 1950, the share of agriculture had fallen to 12 per cent, the share of manufacturing had peaked, at 24 per cent, and the share of services had reached 64 per cent. By 2020, the employment shares of these three sectors reached under 2 per cent, 8 per cent and 91 per cent, respectively. The evolution of these shares describes the employment pattern of modern economic growth. It is broadly what happens as countries become richer, whether they are big or small or run trade surpluses or deficits. It is an iron economic law.

Thus the fetishization of manufacturing jobs misses the point — also explaining the nostalgic nature of the quest.

Almost an academic degree’s worth of understanding in one graf:

What happens is the pattern seen in the US and other contemporary high-income countries (except city-states, where food was partly imported from outside). Initially, two positive forces — cheaper food and higher incomes — shift spending towards manufactures and drive up the share of manufacturing in employment. But two negative forces — the decline in prices of manufactures relative to services and the higher income elasticity of demand for the latter — do the reverse. Initially, the positive effects on manufacturing dominate, because the agricultural revolution is so huge. Yet there comes a time when agriculture is too small to provide a positive impulse to manufacturing. Then forces operating within manufacturing and the service sector dominate. Employment shares in manufacturing start to fall. In the US, these have been falling for seven decades. The idea that this process is reversible is ridiculous. Water flows downhill for a good reason.

Looking ahead, even more harsh reality:

In manufacturing, tasks are repetitive and must be done precisely in a controlled environment. This is perfect for robots. The overwhelming probability then is that in a few decades nobody will work on a production line.

So we are barking up the wrong tree:

Fetishising manufacturing cannot restore the old labour force. Worse, the Trump tariffs will not only fail to achieve that goal, but will cause further malign side-effects. Not least, they will create a clash between the effects of the tariffs, the intended expulsion of millions of illegal immigrants and the planned tax cuts.

No wonder Trump 2.0 believes in a big bang/wrecking ball approach: as it crashes through all levels of economic logic, its illogic becomes clear. So, best to cover that inescapable reality with all sorts of populist, damn-the-torpedoes rhetoric.

Bread and circuses … or just some TV wrestling shows.

3) Already with the rich/old India!

THE HINDU: Can India get rich before growing old?

These articles began with China years ago, and they’re just starting up with India.

Even though three-fourths of India’s population is aged 15-64, the dividend, as it turns out, is not the silver bullet that we have held it out to be, nor is it perpetual. India’s total fertility rate (TFR) — the average number of children a woman has in her lifetime — is declining at a faster pace than was anticipated a decade ago. Projections suggest that within 10 years, the proportion of working-age individuals in the total population will begin to fall, marking the beginning of the end of India’s demographic dividend. Most States are now below the replacement-level fertility rate of 2.1 children per woman, needed to maintain a stable population. Southern States such as Andhra Pradesh and Karnataka, with TFRs below 1.75, are leading this trend. Other States, including Punjab and West Bengal, are also experiencing similar declines, indicating that this is a nationwide phenomenon.

The clock ticks faster with each iteration. America’s demographic dividend seemed to last forever. Japan’s was lengthy. China’s seem unstoppable and then it wasn’t. India’s will proceed at an unfairly fast pace. That just seems to be the reality as globalization expands and evolves. Timelines shrink. Urgency begets agency, if you’re lucky.

4) Much like playing in NFL, serving in the military hurts your head

NYT: Chronic Brain Trauma Is Extensive in Navy’s Elite Speedboat Crews

While briefly embedded as a journalist (Esquire) with CJTF-HOA (Combined Joint Task Force — Horn of Africa [Djibouti]) personnel in East Africa back in the mid-aughts, I got to ride on one of these high speed rigid inflatable boats (RIB) with the Navy’s special ops guys. It was a learning experience for the new deputy commander (naval one-star) and I was trailing him at that moment in Kenya after delivering a speech at the national war college there (I was multitasking on that trip).

I remember the ride distinctly. I was one of those guys standing in the back, knees bent, riding this bucking bull and carefully watching the hand signals of the co-pilot who would warn us of turns so we wouldn’t go flying off (easy to do unless you counter-leaned big-time).

We reached about 60mph on water, which is something.

When I got off, the feeling reminded me decidedly of a high school football game (my topping-out football experience) where I was concussed in a hit from behind (not to my head but shoulders, snapping my head back violently). I don’t remember much about that particular game (homecoming against our chief rival Riverdale from Muscoda) after that catch, although I have a picture from the local paper showing me catch the winning TD (which I vaguely remember).

I do most decidedly remember thinking at that point that I was done with football after high school. I had considered trying to walk-on at Wisconsin (far easier back then) as a receiver, but that one hit really cured me of that ambition/dream. I went on to do similarly bad things to my brain via other means.

When I saw this article, I was unsurprised. Being in the military is a lot like being in the NFL: you spend your body down as the price. This is why such a large proportion of vets are legitimately disabled upon retirement — just like NFL retirees.

This is also why military pensions are so sacred.

5) This isn’t about this century but the next

NYT: Fossil Fuels Are Still Winning’: Global Emissions Head for a Record

The gist:

Countries promised to move away from coal, oil and natural gas at last year’s climate summit. New research shows they’re burning more than ever before.

No surprise. We’re in the middle of a rough doubling of the global middle class (from 3b to 6b by 2050) and almost all of that growth is happening in rising economies located more in the Global South than North. And yeah, they’re fossil-fuel-burning themselves like crazy to catch-up while the catching-up is good — to include getting in under the wire of climate change’s worst impacts.

And yes, I get that irony.

But the wrong answer is this: the Global North passing on its responsibilities to go green or aid the Global South in handling climate change just because the rising South economies are repeating our past sins. That is hypocritical in the worst way, but very Trumpian.

The reality:

Emissions will most likely decline this year in the United States and Europe, and fossil fuel use in China slowed. Yet that was offset by a surge in carbon dioxide from India and the rest of the world.

You want the Global South to go green? Then make it happen. China is working that angle like crazy. The US, under Trump 2.0, is gearing up to walk away from that sort of government-led investment push in renewable energy production.

We are choosing to behave badly right at the moment when it will cost us the most competitive economic benefits.

Own goal, baby!

6) The oddest couple

AXIOS: Behind the Curtain: The Trump, Musk fusion

INDEPENDENT: Elon Musk compared to ‘guest who wouldn’t leave’ after lengthy Mar-a-Lago stay

The notion is, it cannot last.

Two world-class egos who always need to be the center of attention.

We shall see, but I would bet on a nasty breakup before the end of 2025.

7) The most bottom of lines

ICC: The economic cost of extreme weather events

From the exec summary:

Climate change is driving extreme weather events, with a marked 83% increase in recorded climate disasters between 1980–1999 and 2000– 2019. These events disproportionately impact vulnerable regions and socio-economic groups across the world, compounding existing challenges for those already disadvantaged.

The impacts of climate-related extreme weather events span a complex array of direct impacts to physical and human capital and indirect impacts to the wider economy. Direct physical impacts include the destruction of private dwellings, commercial property and infrastructure—such as roads, energy sources, and housing—along with damage to agriculture and food supplies. Human capital impacts are also stark: premature deaths, injuries, and health issues caused by extreme conditions not only represent a tragic toll but also contribute to lost productivity and place additional strain on healthcare systems. Beyond this, broader economic impacts ripple through affected areas, disrupting local supply chains, causing displacement of populations, and discouraging investment.

These events also widen existing socio-economic inequalities—with vulnerable communities often experiencing the worst outcomes—which in turn places significant pressure on government finances as public funds are redirected to relief, recovery, and resilience measures. A single climate-related extreme weather event can have cascading effects across multiple sectors, underscoring the long-lasting challenges faced by countries vulnerable to climate shocks.

Point being, we are just beginning to understand how to truly price these costs.

An interesting but troubling read, the key take-away being that my vulnerable Middle Earth (stretching 30 degrees north and south of the equator) nations are very unlikely to be able to handle this compounding damage over time.

That’s my compelling argument for pro-active North-South integration. We need to spread the strategic risk latitudinally (the only way it makes sense). To expect Middle Earth to muddle through on its own is a fantasy that will only buy us uncontrollable poleward mass migration across this century.

8) Show me the money!

VISUAL CAPITALIST: Global Wealth Distribution by Region

What I find fascinating here is how this categorization scheme validates my three vertical slices scheme: you have your West, you have your East, and you have your Center slice.

Notice also how the West is the best? I mean, the richest?

But also notice how the East presently dominates both the lowest and the middle economic ranks, and how the Center slice is so divergent between rich North and poor South.

Also note that lack of data from Africa proper, which would make that latter disparity all the more profound.

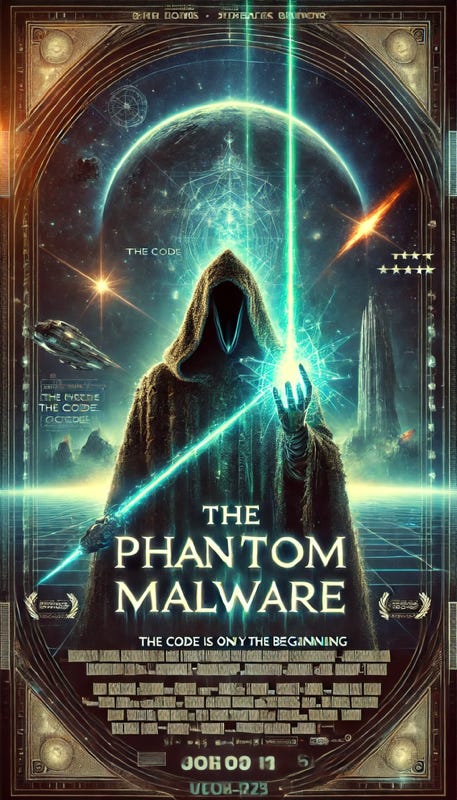

9) AI as the atrophier of skills

.CODA: I’m a neurology ICU nurse. The creep of AI in our hospitals terrifies me

Fascinating read.

I spent the last two weeks post OODAcon24 getting ready to run a Throughline scenario-building workshop at the Society for Information Managers’ (SIM) Tech Exec 24 event in Scottsdale next week.

From the agenda:

10:45 am - 11:45 am

SIM General Session

Broad Framing

Presented by Thomas P.M. Barnett, Ph.D. - Author & Senior Business Strategist, Throughline

In this crowdsourced session, Dr. Barnett will lead attendees in a scenario-building drill that posits a 2040 landscape in which (a) AI is either comprehensively integrated throughout society, the economy, politics, and national security or it is restricted by law and popular demand to certain areas of activity; and (b) cybersecurity keeps pace with AI’s development or falls hopelessly behind. With those two questions yielding four outcomes, attendees will have the opportunity to populate this quartet of scenario pathways during the session using their smart phones, with instantaneous reactions and discussion moderated by Barnett. Here’s your chance to pen some headlines from the future!

It’ll be me playing Phil Donahue (deep cut reference) with 100-plus CIOs (chief information officers) as we Mentimeter our way through the future of AI.

The too-fast scenario (pervasive AI presence but information security does not keep pace), we’re calling The Phantom Malware.

Here is the AI-generated movie poster for that scenario (I will share the other three later on this week):

My spouse worried that all these middle-aged CIOs wouldn’t get the deep cut Star Wars reference. I assured her otherwise.

One characteristic I developed for that scenario (which I built by heavily utilizing AI to predict the future of AI and to come up with a funny movie poster as well): the atrophy of certain human skills, and that is what this article is talking about.

On the surface, AI beats humans but it also stupefies humans and that is bad. Why? Because AI + humans (Centaur solution) beats AI straight up.

Thus, allowing AI to atrophy certain human brain skills? Very bad and something to guard against in that fear-filled, robots-kill-all-humans way.

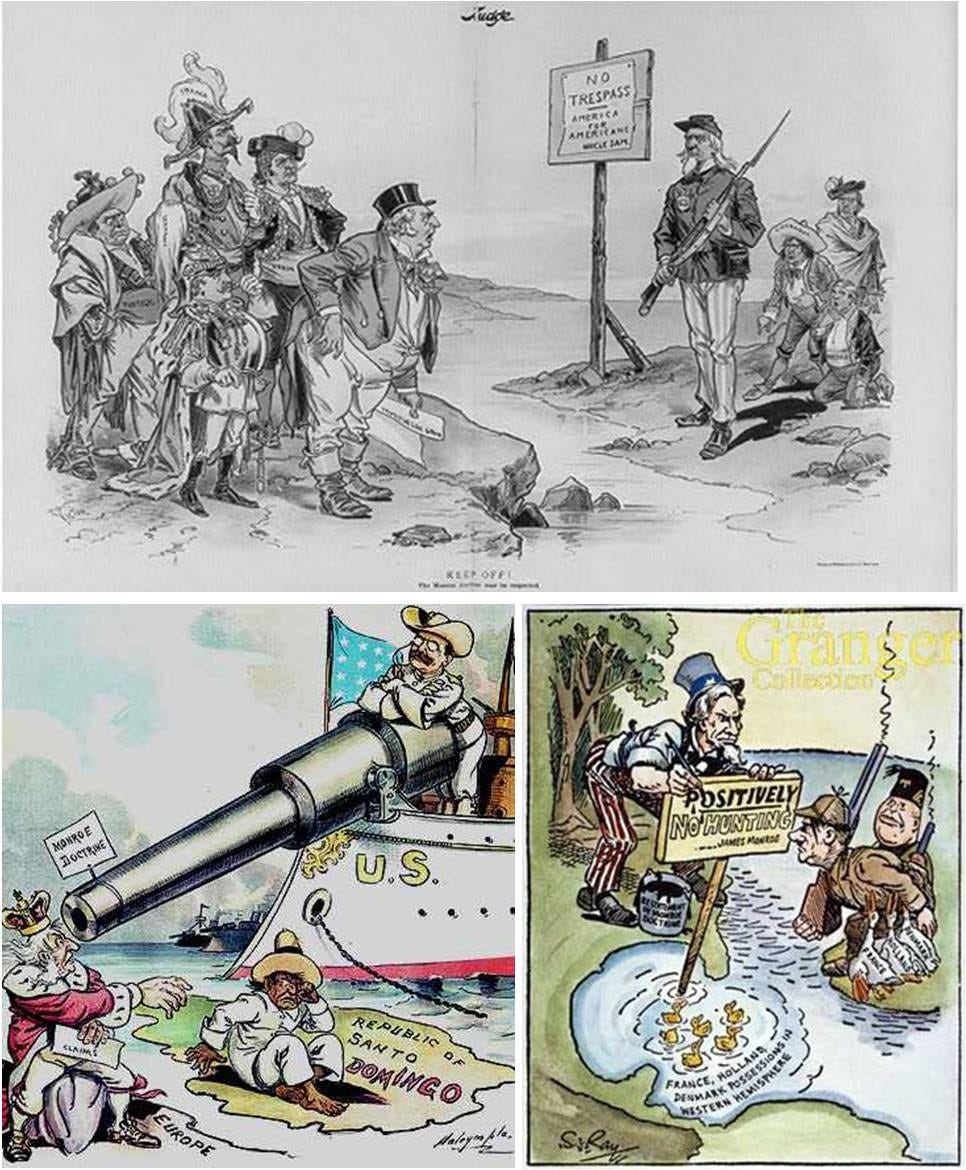

10) The Roosevelt Corollary … resurfaces!

FOREIGN POLICY: 2024 APEC Summit: China Shifts BRI Investment Strategy in Latin America

China’s Belt and Road Initiative across Latin America has — unsurprisingly made China into something else besides an infrastructure builder without peer:

The BRI has shifted China from being Latin America’s ATM to its biggest debt collector. China rivals the World Bank and the Inter-American Development Bank as the biggest creditor in the region and has left Latin America with the highest level of debt service payments in the world, at an estimated of regional GDP.

Recall your Roosevelt Corollary to the Monroe Doctrine:

Although the Monroe Doctrine of 1823 was essentially passive (it asked that Europeans not increase their influence or recolonize any part of the Western Hemisphere), by the 20th century a more confident United States was willing to take on the role of regional policeman. In the early 1900s Roosevelt grew concerned that a crisis between Venezuela and its creditors could spark an invasion of that nation by European powers. The Roosevelt Corollary of December 1904 stated that the United States would intervene as a last resort to ensure that other nations in the Western Hemisphere fulfilled their obligations to international creditors, and did not violate the rights of the United States or invite “foreign aggression to the detriment of the entire body of American nations.”

This struggle will eventually surface. Only gurglings from our side to-date, but that will change.

11) Elections without consequences?

FORBES: Renewable Energy Shift Unstoppable Despite U.S. Election Result

The argument from COP29:

The worldwide transition to renewable energy is now unstoppable. Renewables are cheap and available everywhere and that is they are considered a major contributor to national security. Delaying the transition to clean solutions, will mean losing competitiveness vis a vis countries like China that will reap the benefits of their leadership in the development of clean energy supply chains (from extraction of critical materials and manufacturing, to combining clean solutions like renewables, electric vehicles and battery storage).

Companies invest in countries that offer long-term policy that is consistent. Even under the shadow of changing US policies, forecasts indicate that the market for core clean technologies like solar panels, wind energy, electric vehicles, and advanced energy storage will triple in value by 2035, matching the current scale of the crude oil market.

I know, I know. Most of the coverage of COP29 ridiculed its call for a new global financial framework (North to South money flow) to deal with climate change.

As I argue: nice try, but it won’t happen as aid, only as investment. Thus, the key to making that flow happen and work is to put those vulnerable Middle Earth nations on an explicit accession track to eventual membership in larger North-South unions (the EU’s eastward push of the past three decades replicated southward, for example).

Still, while keeping that long-term goal in mind, it is good to see that America’s latest Trumpian reversal won’t slow things down much in the renewable energy realm. It’ll just cost us our competitive participation in this all-important global economic and technological race.

Sigh!

12) Cosmic Karma

NYT: The Onion Says It Has Bought Infowars, Alex Jones’s Site, Out of Bankruptcy

I came within five minutes of going on Infowars while I was still a Naval War College professor. An assistant of mine at the then-side company I was running (The NewRuleSets.Project) got me the gig without telling me much in advance. About 15 minutes before I was to go on air with Jones, I did a quick internet search and realized no-effing-way am I getting on with this nut.

Jones, operating live, then spent the next hour cursing me up and down on the air for chickening out. He wanted to grill me on my secret Y2K plans within the US Government to institute martial law, it seemed.

I have since counted myself lucky and yet … it would have been something alright.

Anyway, in a moment of great karmic justice, The Onion bought out Infowars at an auction designed to drain Jones of his money so as to pay off his court-ordered debt to the families of the Sandy Hook victims.

There is a God and she’s laughing hard on that one.

The auction is being reviewed by a court.