1) This is your electorate on change elections

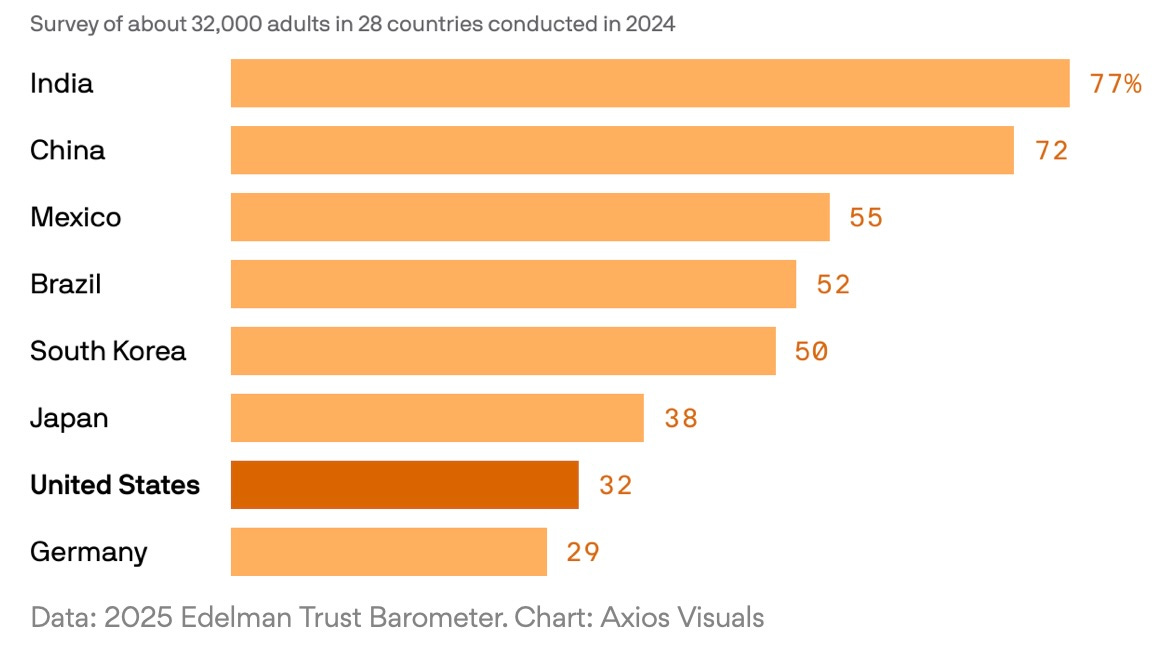

VISUAL CAPITALIST: How Much People Trust Institutions, by Country

Why does China rank so high? A government that delivers on economic growth and performed well during COVID.

India right up there because Modi, until very recently, was delivering the infrastructure and upping government services.

That’s the competition.

The US is way behind, falling into the low-trust category. We even trail out neighbors Canada and Mexico — two middle-of-the-roaders.

Whom to blame in the US?

Government performance, certainly nothing special. COVID didn’t help.

Four-plus decades of GOP bashing the government, with that brief respite afforded by 9/11.

Overall distrust in science and experts in general — ditto.

Polarized politics and the near-total absence of un-slanted media.

Finally, we lack not demagogues able to take advantage.

Investors always say to follow the lead of local money because they know the situation best. If so, America is in trouble.

If we citizens don’t trust our institutions, then why should anybody in this world, even when it comes to our reserve currency status?

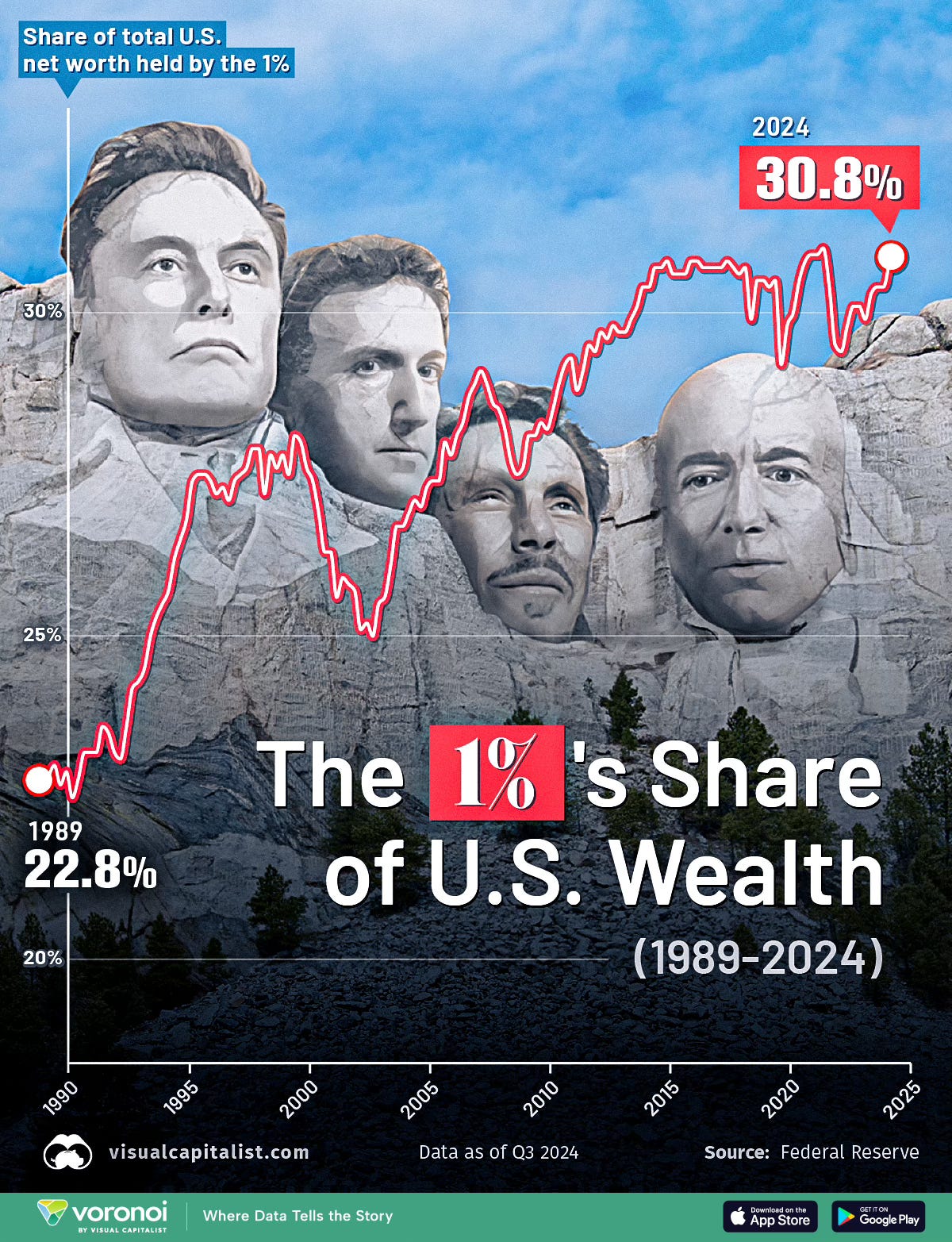

2) Eat the rich

VISUAL CAPITALIST: The 1%’s Share of U.S. Wealth Over Time (1989-2024)

Three of the four (Musk, Zuckerberg, Bezos) attended Trump’s by-invitation-only inauguration inside the Capitol dome, with only Ellison missing out. It definitely had a Gilded Age feel to it: industrial titans installing their man.

That Gilded Age (1870s-1880s) featured similarly gross inequality, with the top 1% of American males (women were still basically property in a marriage) possessing 30% of the nation’s wealth in 1870, rising to 40% by 1913.

Why cite 1913? The 16th Amendment, ratified on February 3, 1913, established Congress's right to impose a federal income tax.

As we know today, the truly rich pay no taxes. That’s just for suckers and losers, with the major transfers going from blue states to red states — those hotbeds of anti-government fervor.

We can only hope all this dismantling of the USG will spread the pain in the same disproportionate manner.

Meanwhile, the uber rich are getting what they paid for in this presidency so far, so no complaints allowed.

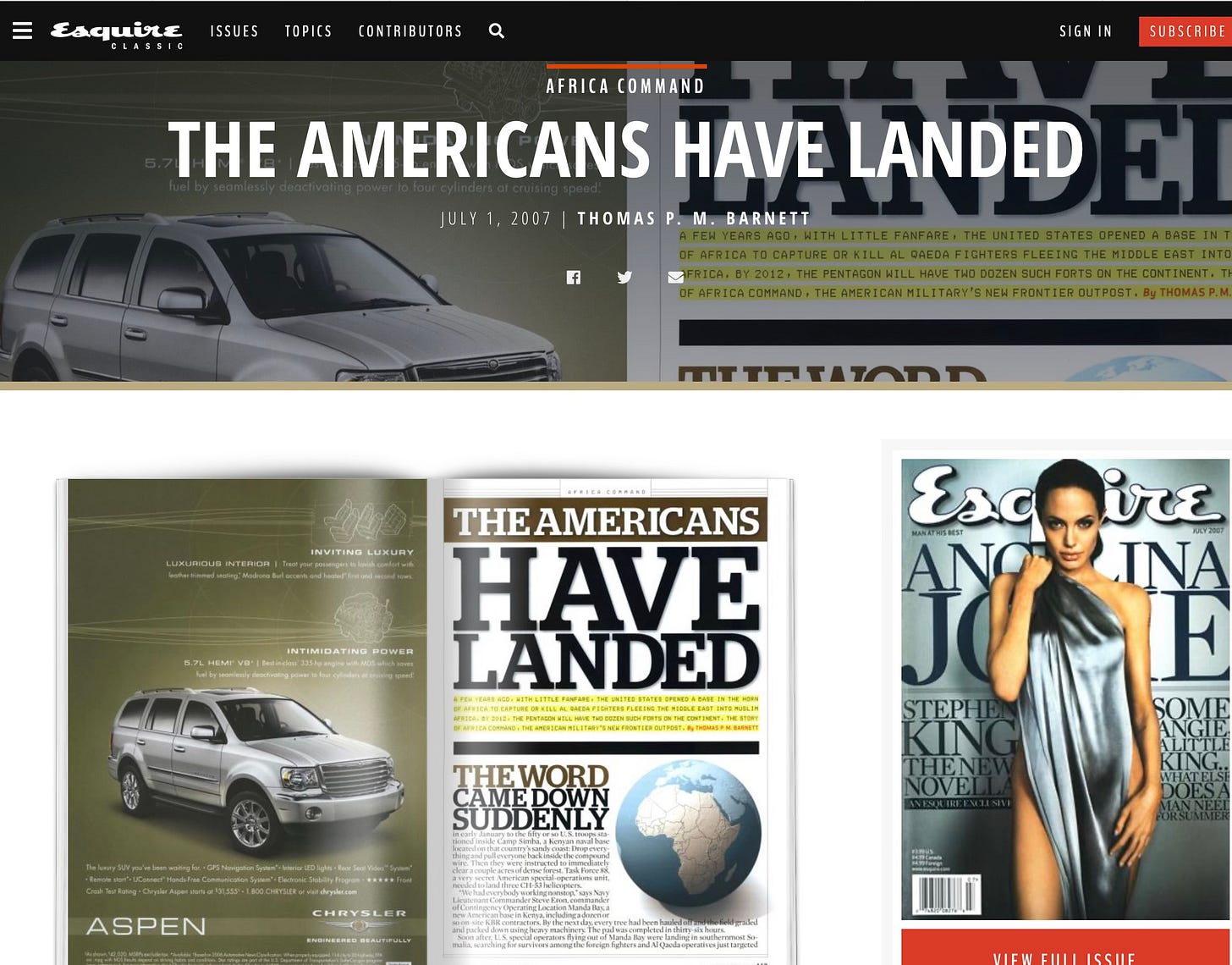

3) The last battlefield — still

WAPO: The Islamic State has regrouped in Somalia — and has global ambitions

The US military’s intervention in Somalia under Clinton was a difficult, messy affair, but one that taught the Marines plenty for what would come later in the Global War on Terror.

The US created CJTF-HOA (Combined Joint Task Force — Horn of Africa) in neighboring Djibouti in 2002 as sort of a picket line to prevent the spread of radical Islamic terror groups into Africa from the Middle East. I embedded as a journalist (Esquire) with the command for a week or so in the summer of 2007, traveling from Djibouti to North Kenya and a forward operating base (FOB) a bit in from the coast near Lamu, from which US military strikes against Somalia-based terror groups had just been launched.

Seventeen years later, HOA is still there, along with about 30 installations throughout the continent (all now part of AFRICOM, stood up in 2008), and so too are the latest iteration of radical Islamic terror groups.

What I wrote for Esquire in 2007 was that we’d be there for decades because this would be radical Islam’s last stand after being pushed out of the Middle East and denied sufficient standing/success in Central Asia. In comparison, Africa would put up less resistance, state-wise, and offer plenty of conflicts to which such groups could append themselves.

That prediction is holding up well, unfortunately, dovetailing, as it does, with the stress that climate change is putting on the entire Trans-Sahel region.

From the WAPO story:

The Somali branch has become the Islamic State’s new operational and financial hub, according to U.S. Africa Command (Africom), and local officials estimate there are as many as 1,000 militants under its command. Large numbers of foreign fighters have flowed into Somalia, establishing a formidable force that now threatens Western targets. The group has also become a key source of funding for other Islamic State affiliates around the world, which have killed thousands of people, including U.S. soldiers, according to U.N. investigators.

Hard to tell, for now, what the Trump Administration’s appetite for this will be. Trump ordered his first military strike on 1 Feb in northern Somalia, but likewise froze and will likely terminate US foreign aid to most of these states. I would expect occasional punitive strikes — largely for show, and nothing else.

4) Not the worst idea

WILSON CENTER: 360° View of a US Sovereign Wealth Fund

Lost in the flood emanating from the White House: the notion of starting up a sovereign wealth fund for the nation.

From a host of think tankers at Wilson, the rationale:

Today, the United States faces mounting risks from the metaphorical lack of a nail—inadequate equity investment that could activate other capital to secure global investments critical to its national interests. More broadly and more effectively assisting emerging markets in meeting their own infrastructure needs is also a vital front in today’s strategic competition.

So, the notion that investors are sitting on too much money at home that could be motivated toward better use … if the USG’s SWF pointed the way and signaled likely profits, plus we gotta take on China’s Belt and Road Initiative across the Global South.

I’ve long known of the latter deficit, haven’t heard much about the former in quite some time. But I get the idea: whenever a US SWF were to place a bet, it would spark a wider private-sector flow. So, maybe that versus Biden’s rather expensive outlay for infrastructure ($1T off the bat, a multiple more down the road toward 2050).

Yes, the US has some lettered financial agencies (OPIC, DFC) supposed to work the Global South, but China is playing at an entirely different level:

China has achieved much of its dominance by subsidizing investments and leveraging equity, not just debt. In contrast, the US lacks an equivalent mechanism to counter Beijing’s Belt and Road Initiative (BRI).

Details:

China has financial stakes in nearly 100 ports worldwide, while the US has virtually none …

Huawei dominates 70% of Africa’s telecommunications backbone, granting China unparalleled control and access to data that could train its AI systems …

A SWF could help extricate the US from China’s chokehold on critical mineral supplies …

the Indo-Pacific is the epicenter of today’s strategic competition and investments such as those made to keep the port near Subic Bay, the Philippines, in safe hands are vital.

Lines of communication — both sea and telecom — are the focus of all that future consumption across the Global South, as we sure as hell ain’t building ports for advanced economies.

Interesting to me: the US couldn’t see its way to this sort of engagement and connectivity-centric strategy during its Global War on Terror, when I argued for a SysAdmin “force” and a Department of Everything Else (Musk-ian name, I admit, but it’s where I would have put USAID versus gutting it) to focus on just that sort of competition (Who invests more strategically in global connectivity?).

No, it took the FOMO generated by China’s Belt and Road Initiative these past ten years to get us to thinking along such lines.

And, if the Ukraine war effectively teaches the Pentagon that the future force is the many, the cheap, the disposable, and the unmanned, then maybe — just maybe — the USG will be able to afford a SWF — in effect, symmetrizing the soft-power competition with China across the Global South.

5) Speaking of the Military Singularity

AXIOS: Future of Defense

Drones 3-D printed in hours, basically anywhere you want.

We’re supposed to be awed by China’s great shipbuilding prowess. But, if we can sink ‘em with 3D on-demand printed drones manufactured in-theater, maybe we shouldn’t be.

Truly transformational by ending the tyranny of being “held hostage by specialty parts, single producers and backorders.”

As these small upstart firms revolutionize the defense industrial complex, we should expect the big legacy companies to snatch them up — or at least try to. If I were the USG, I would seek to prevent that.

Old habits die hard: ‘The Pentagon not so long ago favored expensive and exquisite over cheap and plentiful.”

But what a difference Ukraine the Conflict has made, unleashing tech leaps “every other month.”

6) Rivers overhead, floods below

USA TODAY: Record rain in California: 2 dead; home swept away by river

NYT: Why California’s Wettest Storms Can Be Its Trickiest; Atmospheric rivers like the ones hitting the state this week sometimes wobble, and these slight movements can be challenging to predict.

Read it and weep:

A series of "atmospheric river" storms aimed at Northern California have already caused flooding, downed trees, landslides and at least one house on a scenic river to slide into the water on Tuesday, with another storm coming on Thursday and yet another one next week. At least two people have died.

San Francisco broke a daily record for rain that had been in place since 1887 on Tuesday, with a pounding 2.53 inches of rain falling, according to the National Weather Service. The rain was so heavy at times that it fell in almost white vertical sheets, quickly overwhelming storm drains in some areas.

Mount Tamalpais in Marin County just north of the city recorded a full 17 inches of rain between Friday and Thursday morning, said Crystal Oudit, a meteorologist with the National Weather Service's San Francisco Bay office.

The storm was especially violent north of San Francisco, in Sonoma county, where the scenic and popular Russian River reached flood stage leading to multiple evacuations.

A follow-on atmospheric river was already forming over the Pacific when this one hit land. Although almost the complete opposite — in structure — of a hurricane (long and narrow and piercing versus round and rotating and broad), ARs can be tracked quite similarly, it would seem. There’s even an AR equivalent of the hurricane strength calculation.

Still, ARs are considered tricky beasts when it comes to the ultimate paths they take — more like a tornado.

Interesting, yes, that none of us seemed to know what an AR was five years ago — or a “derecho” (my favorite). This is what a changing and challenging climate has accomplished: we all pay a lot more attention to the weather.

7) You mess with the bull, you get the horns

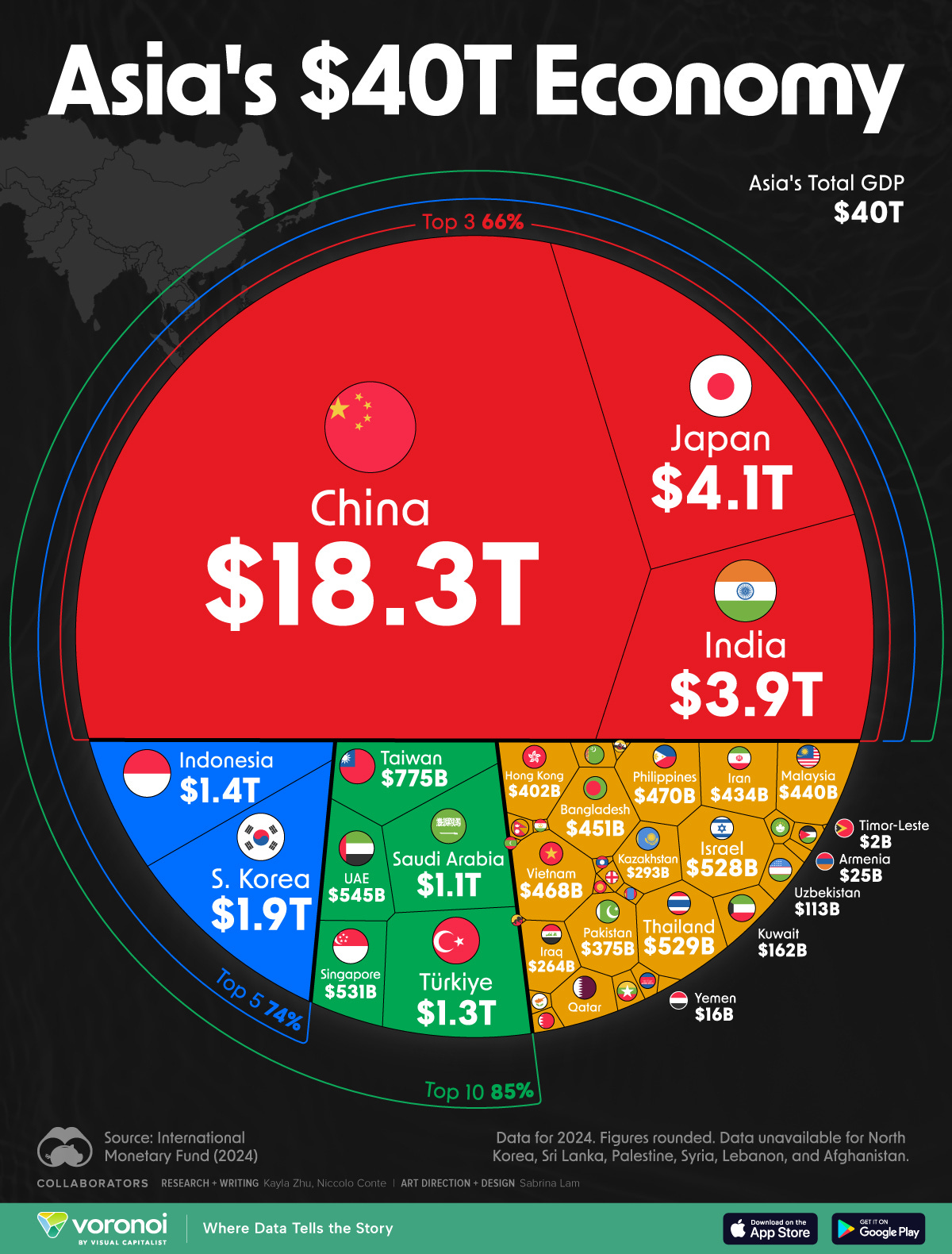

VISUAL CAPITALIST: Visualizing Asia’s $40 Trillion Economy

China’s military doesn’t make it strong; China’s economic heft makes it strong.

Nothing the US is going to do will seriously challenge China’s economic domination of Asia — other than encouraging and enabling India’s rise.

8) Here comes the sun!

ECONOMIST: Sunburst; Cheap solar power is sending electrical grids into a death spiral — Pakistan and South Africa provide a warning for other countries

Nice bit of history:

In 1812 Frederick Winsor, a madcap entrepreneur, invented the public utility. The idea behind his Gas Light and Coke company, which would supply residents of London, was that instead of each household buying its own energy—bags of coal, bits of firewood—the stuff would be piped directly to them from a central location. More customers, with differing patterns of demand, would allow power plants to be used more efficiently. It was a natural monopoly: scale would spread the cost of the gasworks, the pipes and so on across large numbers of customers, each spending less than they would individually to consume just as much. The idea of “energy as a service” spread across the world.

But cheap solar power is now breaking the model.

The snake is eating itself in places like Pakistan, which is importing solar panels like crazy, allowing households and businesses to go off-grid, thus leaving a smaller pool of customers to foot the bill of coal-fire electricity. As those consumers become overburdened, they are incentivized to follow the crowd on solar.

Traditionally, a lot of electricity grids in developing economies resort to “load shedding” whenever they can’t meet demand (cutting off power for periods to certain customers). This too drives customers to go solar.

So, higher prices and service interruptions versus tapping solar: the latter is going to win every time, creating the death-spiral problem for tradition utilities.

For those look-ahead thinkers on the subject, like my friend Amory Lovins quoted here, the future is one in which centralized power production is no longer needed. Instead, it’s like an Energy of Things set-up where everybody’s this-and-that energy production element is linked up and shared and sold back and forth (prosuming).

That future takes a lot of sensors and big data and edge computing and AI/ML to manage it all — the smart microgrid that is, itself, merely a cell among cells that service a city, region, or nation.

This is not a monopoly build-out, like the original one associated with industrialization. Nope, this is the cantina scene from Star Wars with universal translators making sense of it all.

Exciting stuff, very much what I’m into now with Artesion.

9) A solid prediction for almost two decades now

WAPO: Israel likely to strike Iran in coming months, warns U.S. intelligence

Says the guy who got the head of CENTCOM fired in 2008 with a story in Esquire about his struggle with Bush Administration Iran hawks.

Eventually … the intelligence community will be right.

Lots of ways for this to unfold. I designed and lead a crowdsourced simulation of this for Wikistrat years ago. It’s no longer available online because the firm re-ran the drill over a year ago.

Point being, this will be the most anti-climactic strike in human history.

Two decades in the making!

10) Another county heard from

ATLANTIC COUNCIL: Welcome to 2035: What the world could look like in ten years, according to more than 350 experts

Tell me the year in which a majority of security experts weren’t predicting a world war within the next decade.

I’ve been doing this for money for four decades now, and can’t recall the year I could haven’t gotten this poll result.’

As soon as the Soviets cracked, we entertained (seriously!) the notion of was with Japan. Once Japan’s economy tanked (forever, it seemed), we were back to a “reconstituted” Russian threat, along with eyeing China “all grown up.”

9/11 actually birthed a “global war,” at least rhetorically. But, as soon as the Great Financial Crisis hit in 2008, we were back to the narrative that we were repeating the 1930s with China as the stand-in for Imperial Japan.

Then Russia punched its way back into contention in 2014 with Ukraine.

In the background noise, there’s almost always been the Iran-gets-nukes-so-Israel-strikes-triggering-wider-regional-war-that-goes-global-and-nuclear scenario.

Putin going into Ukraine IS WWIII(!) for plenty of hysterics in the national security community.

And, of course, we now know for certain that China must invade Taiwan in 2027 as part of celebrating the 100th anniversary of the PLA.

Simply put, that dance card has been full my entire career.

This is not news; this is the precious metals industry hawking now is the best time to invest in gold!

11) Ixnay on AI in the USA

AXIOS: Exclusive: America's AI doubts

America is low on institutional trust, so no surprise we’re way behind China and others on trusting AI — aka, the need for Explainable Artificial Intelligence (XAI).

Axios states it simply (oh the sheer brevity!):

Why it matters: The pace of AI adoption won't solely be determined by how fast the technology itself advances, but also by the willingness of businesses and individuals to use it.

With all our angry populism, still strong enough that independent voters keep signaling to the Trump Administration that we want more! (noted in same Axios newsletter), we are unlikely to see Americans’ faith in AI grow much stronger, and that’s a real problem.

AI is custom built for conspiracy theories — our current opioid of the masses.

If you can’t trust experts and feel the need to demonize the government, then how do you get Americans to trust AI?

Daunting proposition for these times.

12) 90/10 ain’t cutting it on climate change

WAPO: Scientists have a new explanation for the last two years of record heat

FOREIGN AFFAIRS: The Adaptation Imperative

LIVE SCIENCE: Greenland's ice sheet — the second biggest in the world — is cracking open at alarming speed, scientists discover

As evidence piles up on vicious cycles — like the record heat of the last two years being linked to ever-more-sparse cloud cover (or Greenland’s Big Melt outpacing all predictions), awareness grows that our current spending pattern of 90% on mitigation and only 10% on adaptation needs to be drastically rebalanced — if not reversed.

You can’t improve what you can’t measure:

Private investors in climate adaptation are scarce because the return on investment can be difficult to discern. Many adaptation projects generate public benefits rather than direct revenue streams. Governments and philanthropists may therefore have to jump-start adaptation projects, just as they do with mitigation, by, for example, providing grants or low-interest loans to communities and individuals. At the same time, improved measures of the effectiveness of adaptation investments should make it easier to attract funding, as better visibility for the outcomes builds investor and philanthropic confidence.

I agree with the FA article’s judgment: adaptation needs to take center stage.