The Coming Climate Short

If last night’s debate didn’t depress you enough, here’s something just as disturbing

One speaker who really knocked my socks off at the Los Alamos National Laboratory’s symposium on climate change was a Harvard Law School prof named Susan Crawford.

No slides, just talk, but what a presentation it was.

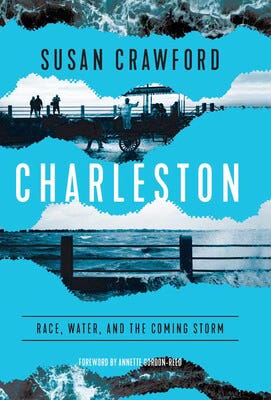

Susan has spent years working climate change from the angle of sea level rise and what that will mean to housing. Her Substack is called Moving Day and she has a recent book out on the subject (Charleston: Race, Water, and the Coming Storm). She has been a columnist at Wired and served as Obama’s Special Assistant for Science, Technology, and Innovation Policy. She is a compelling speaker and has received a lot of primo accolades across her career.

As we know from 2008 (the Big Short that occurred in the housing market, with all those subprime [riskier] mortgages that were packaged up and sold around the world as CDOs [collateralized debt obligations]), America has this tendency to build up significant risk there, only to have it regularly explode.

This is where Crawford, in a more general sense, notes that all our rules and institutions and risk-management schemes are based on a stable climate – and we’re talking basically all human civilization since the beginning of human civilization.

The problem now is that stable climate is escaping into uncharted territory, meaning, in my preferred terminology, we’re on the cusp of a huge ruleset gap – here, environment racing ahead of both economics and politics and, on that basis, invariably racing ahead of security.

[On the brighter side, it is not racing ahead of technology per se, as we have the science and the tech; we just don’t yet have the political will – a big theme of this symposium.]

What that situation sets us up for is a series of painfully disruptive lessons that both reveal those ruleset gaps and force us into severe catch-up mode (like in 2001, 2008, or 2020).

In a bigger sense though, Crawford argues that our systems of life and civilization and governance are all built for preservation — not adaptation. As such, our politicians are not incentivized to respond to climate change (as we see).

This is a crucial observation: right now about 90% of our climate change spending is devoted to mitigation — worthy but only part of the story as we face some big adaptation costs and bills in the years ahead.

Thus, we must be able to walk (mitigate) and chew gum (adapt) at the same time, remembering that, of the three choices forced upon us by climate change (adapt, move, or die), adapt is the least disruptive one and, quite frankly, humanity’s superpower.

It’s just that the domain most likely to serve as a crystalizing climate change experience that finally clues us all in on this dynamic is that housing market.

Why? As Crawford notes, so much our economic system is based on property (mortgages and taxes). When something hits that pillar, our system convulses in response.

In short, it’s a real gut punch.

Some examples of Crawford’s Substack:

Some broad framing of my own:

Keep reading with a 7-day free trial

Subscribe to Thomas P.M. Barnett’s Global Throughlines to keep reading this post and get 7 days of free access to the full post archives.