The Growing Adaptation Deficit

The shift from climate mitigation to adaptation needs to rapidly and radically expand

UN Environment Program puts out regular “Adaptation Gap" reports, and its iteration for this year sounds the usual alarm bells of underfunding.

The summary language:

The report – which looks at progress in planning, financing and implementing adaptation actions – finds that the adaptation finance needs of developing countries are 10-18 times as big as international public finance flows. This is over 50 per cent higher than the previous range estimate.

The modelled costs of adaptation in developing countries are estimated at US$215 billion per year this decade. The adaptation finance needed to implement domestic adaptation priorities is estimated at US$387 billion per year.

Despite these needs, public multilateral and bilateral adaptation finance flows to developing countries declined by 15 per cent to US$21 billion in 2021. As a result of the growing adaptation finance needs and faltering flows, the current adaptation finance gap is now estimated at US$194-366 billion per year. At the same time, adaptation planning and implementation appear to be plateauing. This failure to adapt has massive implications for losses and damages, particularly for the most vulnerable.

The report offers a number of ways to increase official aid flows and private remittances (migrants living in the North sending money down South), but the emphasis — as one would expect with the UN — is on mobilizing public money through international organizations and schemes, with private-sector foreign direct investment (FDI) more of a follower than leader.

Here’s what I had to say about such approaches in America’s New Map:

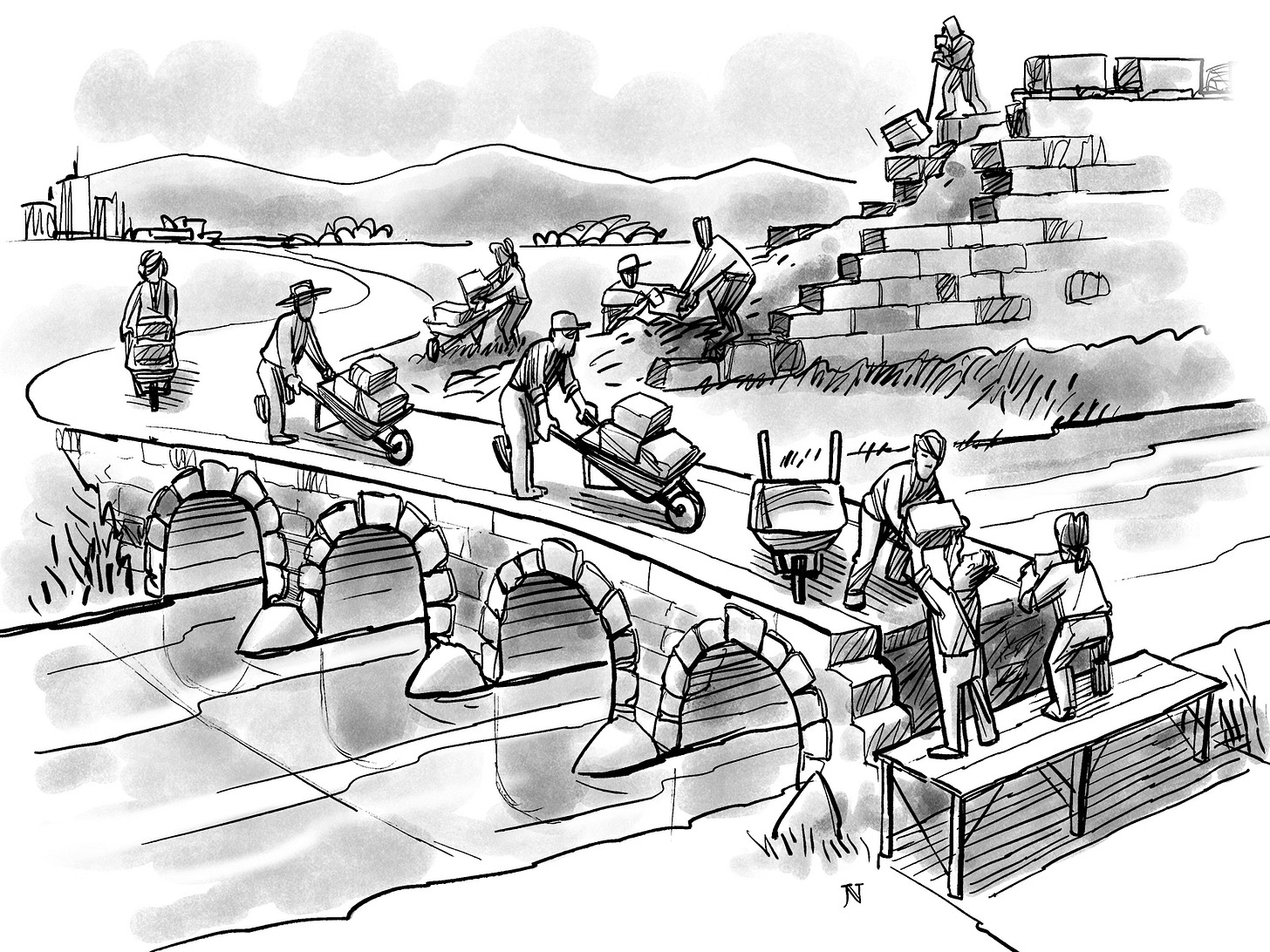

Our choice of bridges versus walls is a powerful signal to our Southern neighbors, the former indicating our openness to salvaging as much of Middle Earth as possible to sustain viable statehood there. Better to link infrastructure development to a pathway for eventual membership in expanding North-South political unions than to simply hand over trillions of dollars in a UN-sponsored global “loss and damage fund” certain to aggravate the North’s angry populism while succumbing to all manner of waste, fraud, and abuse at the hands of local governments ill equipped to manage such spending. By signaling such long- term political intentions, the North creates a far more secure investing environment to the benefit of all. In other words, an effective response here focuses on incentivizing and mobilizing the private sector more than the public sector.

This is where the confluence of climate change and an ascendant global middle class creates a unique historical opportunity: climate change generates geopolitical “orphans” (non-viable states, migrants) at exactly the point when that South-centric middle class seeks maximum belonging (protection of newly acquired status and wealth). That tectonic collision of fear and hope defines this century, demanding that superpowers move beyond their strategic fixation on national defense and embrace a far more expansive definition—and delivery— of security in all its forms.

That is a big theme in my grand strategic approach to climate change: to get the real money (FDI) flowing, those private-sector plays need to see enough certainty across Middle Earth to risk capital. Left to their own devices, countries there won’t attract nearly enough FDI for adaptation purposes: just too scary a long-term picture for investing funds. Trying to backfill that gap with public money? Good luck, as the North ages and grows more defensive and territorial on trade amidst globalization’s ongoing regionalization.

Yes, you can try to fix the rules/legal environment of these places, but that is another tall order amidst growing climate change stressors. So the bold-but-logical step is to extend our ruleset/legal/investment environment southward via state-accession (i.e., bringing them into our expanding American Union — however defined and however the membership might be tiered for openers).

In short, instead of trying to fix these vulnerable Middle Earth states from outside while climate change continues to batter them worse and worse, we adopt them, bringing them inside from the heat, so to speak. We absorb them into our pooled sovereignty (just like the EU and NATO did for Eastern Europe) and, on that basis, let our usual greedy capitalist impulses make the best of their situations as quickly as possible.

You will say, how brutal! How imperialistic! But is anyone of the opinion that a Honduras, say, is poised to succeed on some combination of its own and foreign aid as conditions worsen dramatically?

So, show me a more realistic path in the time remaining before widespread state failure unfolds across Middle Earth. If this whole deal ain’t going to be about investors getting acceptable returns, then we’re hoping those states will survive on the kindness of strangers — or just less-scrupulous and more authoritarian purveyors of the same strategy (like China), just delivered differently.

I see the choice for these vulnerable states being:

Go it alone and fail to the point of state dissolution (and, if you’re lucky, state absorption by a neighboring greater power after that fact)

Hope for foreign aid that will always be too little and too late, ultimately succumbing to paths #1 or #3.

Go with China’s development model with the understanding that Beijing will impose social-control technologies via your local government that is highly incentivized (or just bribed) to play along, hoping the Chinese won’t squeeze you dry like some Mafia scheme and then drop the corpse of your body politic on the side of the road as it moves one to another target.

Sign up for state accession (or some combination of lesser variants, like currency union, free-movement union, free-trade union, investment union, etc.) with the US and friends and find yourselves exploitatively sucked into the America Dream and all the personal and political stressors that can bring — along with state survival under humane conditions.

Honestly, which sounds more plausibly advantageous to the locals long-term?

I mean, do you see climate migrants beating a path to China? I don’t. I see them swarming toward the EU and the US.

Again, my investment-climate approach only works if those actors see a profitable long-term path. If you think the Chinese are thinking any differently — or more generously, then I think you need to lay off the recreational pot.

America is not the great, soon-to-be White majority-minority hope for the entirety of Middle Earth. We really only make sense for Latin America and the Caribbean. Africa is Europe’s and Asia’s to figure out, and the southern Asian rimlands are for that sphere’s superpowers (China and India by far, Russia largely at their hands) to manage.

I know, I know. How can I possibly broach some hemispheric concerns when America’s national security establishment is gearing up in collective response to Ukraine, the Middle East, and our much anticipated (and oftentimes already scheduled) “WWIII” with China?

Look around you.

Our immigration crisis plays bigger domestically than any of those conflicts, individually or collectively. We are not a nation ready to sign up for decades-long Cold Wars or a return to the Mideast’s “forever wars.” Our aged Boomers and aging Xs might be willing to go another time around that block, but our Millennials and Zs are becoming increasingly fixated on addressing the larger, system-level threat that is climate change.

Thus it is time we start discussing realistic approaches to what must come next.

That is my mission in the time I have remaining. I simply owe it my kids.

Get busy adding starts or get busy losing them. That is the climate redemption.