1) US wealth inequality screams for a progressive/corrective era

VISUAL CAPITALIST: Visualizing Wealth Distribution in America (1990-2023)

This chart from Visual Capitalist got me thinking and searching, and I found I liked this variant better:

I like this one better because the simpler presentation make the point more obvious: this is basically the period of peak globalization, or the one in which the West capitalized most prominently on Asia’s rise and successful leveraging of successive demographic dividends (Japan, the Tigers, China). That phase is over and done with, in many ways, but the political legacy lives on in the form of the righteous populism it spawned: namely, the top 10 percent killed it over this time period, yielding all these mega-rich types dominating our economy, society, and — most frightened — our politics with their money.

There is serious detachment brewing here for our democracy: those with the most sway don’t have to answer to the rest of us, since they are self-funded. They see an issue they want to steer and they drop $10 million here or there as they see fit to sway an election — all thanks to the Supreme Court’s decision on Citizens United in 2010 (in effect, politically weaponizing all that incredible wealth).

In this way, a super financialized economy like ours isn’t all that different from one “cursed” by resource wealth: the powerful no longer need the approval of the masses. Instead, the masses exist to be shaped and conditioned and commanded by their immense wealth.

As much as I despise Trump and the vast majority of what he seeks to impose, you cannot dismiss the underlying drivers here. Our choice here is a repeat of the that posed to the West at the turn of the 20th century: the middle is feeling abused and underrepresented. You can fix that by fascism from the Right or socialism from the Left or you can thread that needle by the progressive rule of the Center.

America has plenty of loud voices on the extremes right now (a historical feature of Boomer rule — not a bug), but the Middle lacks articulation, and that is dangerous.

2) Xi stands at the end of his rule, but refuses to move on

WAPO: Xi is tanking China’s economy. That’s bad for the U.S.

Xi Jinping is the primary killer of the China Dream, which was — and remains — a real possibility and — frankly — one we should all still hope for. There is nothing good to be found in China’s peaking right now, because all subsequent panic will harm us all (to include a rising India that might, in its growing hubris, see value or even triumph in this development).

Xi started all this decline by abolishing the presidential term limit in China, sabotaging the highly effective rule-by-leadership-generation model that turned over the political leadership every ten years. That model gave the system a chance for significant course correction, plus a regular reset button on major relationships — adaptability, to put it simply.

That adaptability is gone, so China’s course becomes more defensive at home and more insidious abroad (the stealthy penetration of targeted states through security and surveillance means), condemning China to a stalling-out trajectory that is obvious to the world and — more damagingly to Xi — to the Chinese people themselves.

That is what is killing the China Dream.

WAPO’s editorial sums it up well:

China’s leadership appears paralyzed. The country’s economic policymakers were once well-respected. But Mr. Xi’s centralized rule appears to have stymied decision-making.

The tools are there, says WAPO, listing all the steps the Chinese leadership could take:

A stabilization fund could help shore up lagging equities markets (an idea floated, then abandoned). The government could take over unfinished properties to ensure their completion and to guarantee the prepayments of prospective buyers. It could announce new measures for restructuring local government debt. To bolster consumer spending, they could launch a stimulus program to pass more money directly to people.

To deal with its aging population, China could also widen its meager social safety net for the elderly, including pensions — now scant — and increase health insurance. This could help the economy now; people save rather than spend because of the lack of government support. China should also rethink its official retirement age, now a low 60 for men and an even lower (and unfair) 55 for women.

But Mr. Xi refuses.

Why? He cannot accept any policy shift that suggests that either he or the CCP has made any mistakes. By doing this, he demonstrates the danger of his permanent rule: no more adjustments-by-generation are possible.

The steering wheel is locked and curves lie ahead. China will continue to decline until the generational leadership model is revived, and that won’t happen without a lot more pain.

3) Russia’s escape-hatch model is working

NYT: U.S. Campaign to Isolate Russia Shows Limits After 2 Years of War

NEWSWEEK: Putin is Stronger Than Ever—Why?

Did the West financially de-globalize Russia following Putin’s invasion of Ukraine?

Yes.

But that only forced the Kremlin to execute a pivot to the pillars of the non-West — namely, China, India, and Brazil.

Is it inefficient for Moscow?

Yes, they take a haircut on every price they now achieve, but that’s considered acceptable to Putin, who will squeeze those losses out of the Russian people, as tsars have done for centuries.

Under normal Western circumstances, our primary weapon going forward on Russia would simply be patience. I mean, we know how to do that with Russia, do we not?

But the chink in our shield is grossly apparent and threatening to dismantle Western resistance to Putin’s aggression: the White Christian Nationalism of the MAGA core sees in Putin a leader worth admiring and emulating. Trump gets back into power and voila! Western resistance is gone.

That is Putin’s dream and one the Russian state is working quite hard to achieve, barely concealing its wide campaign to manipulate our national elections (I mean, it hasn’t cost them much to date when they are caught doing it).

Think about this counterfactual: FDR loses re-election in 1936 or 1940 to … Charles Lindberg (a noted fictional plot device). What stops Nazi Germany then?

Then think about a second Trump administration and ask yourself, what stops Putin then? Not Trump. He’s already approved the Kremlin for future westward invasions.

4) The damage unbridled demand can inflict

BBC: Millions of donkeys killed each year to make medicine

The problem is simple enough to describe: Chinese have taste for a specific food additive believed to impart significant health benefits. For time immemorial, that demand was limited to the wealthy of China. Now, China’s economic development has ballooned that demand, creating a demand-pull from around the world — one with huge and very negative implications for local source economies:

In China, a traditional medicinal remedy that is made with the gelatin in donkey skin is in high demand. It is called Ejiao.

It is believed to have health-enhancing and youth-preserving properties. Donkey skins are boiled down to extract the gelatin, which is made into powder, pills or liquid, or is added to food.

The medicinal remedy of this donkey-hide glue is debatable: some studies cite real positives, others suggest it is more hype than efficacious. I don’t doubt there is something to it; I’m just sure that you don’t need donkeys to make it happen in today’s world.

This is just a problem of traditional meeting economic opportunity on a scale that — per the responsiveness of the global economy to such demand — is environmentally and economically unsustainable.

Bull in a china shop (pun intended).

5) Called it

NYT: Netanyahu Issues First Plan for Postwar Gaza

Netanyahu finally spells out his plans for a diminished Gaza:

Prime Minister Benjamin Netanyahu of Israel released on Friday his most detailed proposal yet for a postwar Gaza, pledging to retain indefinite military control over the enclave, while ceding the administration of civilian life to Gazans without links to Hamas.

The plan, if realized, would make it almost impossible to establish a Palestinian state including Gaza and the Israeli-occupied West Bank, at least in the short term. That would likely accelerate a clash between Israel and a growing number of its foreign partners, including the United States, that are pushing for Palestinian sovereignty after the war ends.

That is a much — and permanently — diminished Gaza.

6) Into the woods

VISUAL CAPITALIST: Share of World Forests by Country

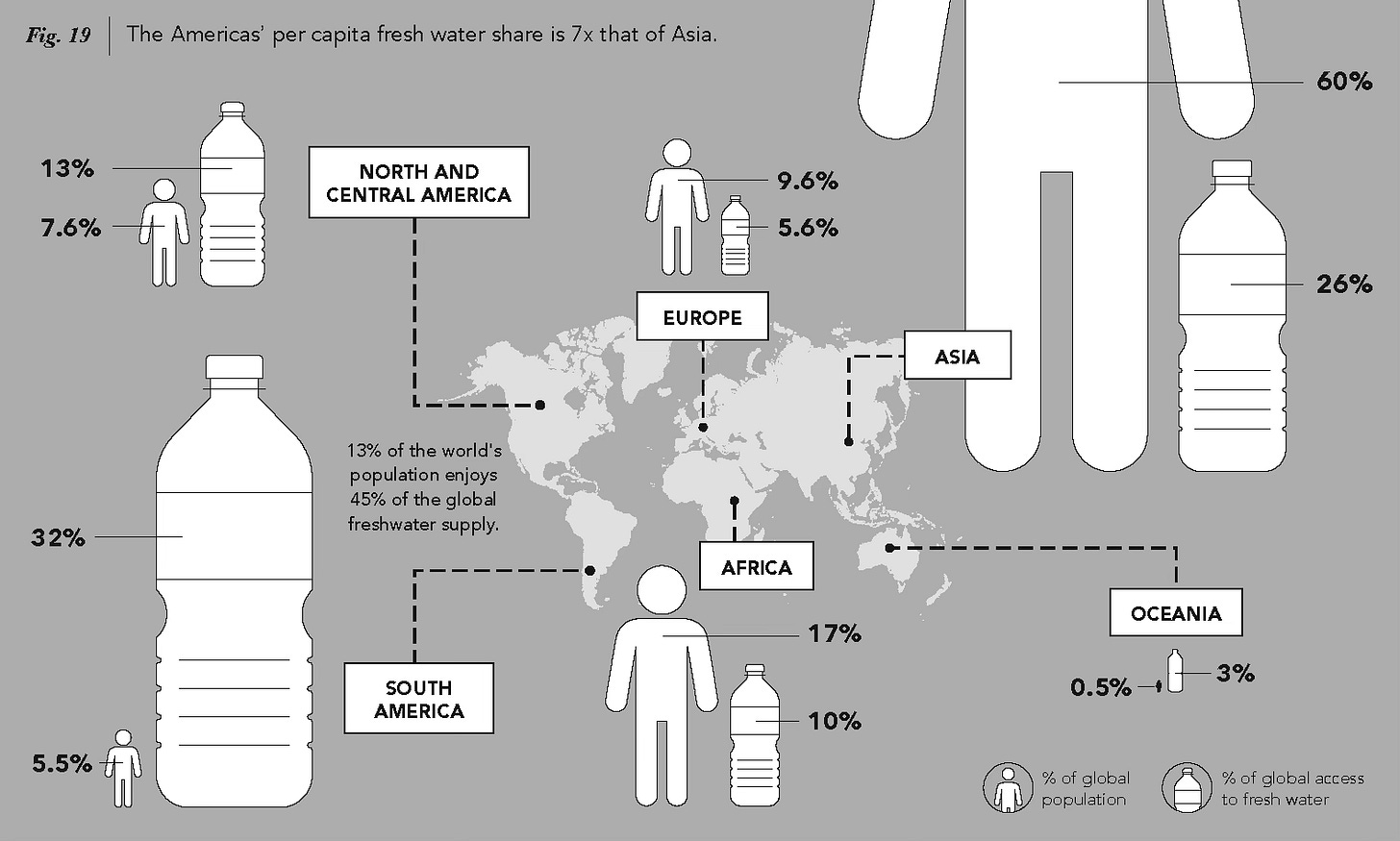

Just mentally adding up the Western Hemisphere’s share: Add up those noted from Latin America, anchored by Brazil, and you see that LATAM basically equals King Kong Russia at one-fifth. Canada plus US gets you another 16%, so, assuming some more in that “Other” category, we’re approaching 40% for an Americas that constitutes a mere 13% of world population — roughly equal to the distribution we see in water.

From ANM:

You got the extra water, per population share, then you likely have a similarly proportional amount of extra forest — so to speak.

The trick on these maps is always Russia, which is both Europe and Asia, and, in this instance, the forests tend to be heavier in the Asia part, as this map shows:

Interesting to know, right?

7) Building an electric car from the battery up

NYT: How China Built BYD, Its Tesla Killer

BYD as a threat to Tesla, when I first heard it, didn’t make any sense to me. BYD is a battery maker, so it would be like the Energizer Bunny suddenly transformer-ing into an electric car. Just plain hard to imagine.

And that is how BYD was received with its first models — like some sort of joke.

Nobody is laughing at BYD now.

The company passed Tesla in worldwide sales of fully electric cars late last year. BYD is building assembly lines in Brazil, Hungary, Thailand and Uzbekistan and preparing to do so in Indonesia and Mexico. It is rapidly expanding exports to Europe. And the company is on the cusp of passing Volkswagen Group, which includes Audi, as the market leader in China.

BYD’s sales, over 80 percent of them in China, have grown by about a million cars in each of the past two years. The last automaker to accomplish that in even one year in the American market was General Motors — and that was in 1946, after G.M. had suspended passenger car sales during the four preceding years because of World War II.

I wrote about this demand-led power in America’s New Map in the Thread entitled “In Globalization, Demand — Not Supply — is Power”:

Most impactful and positive [demand power]: Beijing’s concern over worsening domestic air pollution pushing the government to mandate that electric vehicles (EVs) constitute 40 percent of domestic sales by 2030. Think about how long Amer- icans have waited on Detroit to pursue that initiative and then recognize why suddenly the Big Three car companies are all-in on all-electric vehicles, along with an EU that now says it will allow only EV sales after 2035. It is no mys- tery: China’s new car market is 50 percent larger than ours and double that of the EU. Beijing now wants EVs, which means consumers all over the world are going to get them, too. That is the supremacy of demand over supply in globalization—wanting trumping having.

That’s BYD’s special sauce (along with government subsidies): it is operating in a vast market where the government is pushing for e-vehicles (from the NYT article):

No company has benefited as much from China’s embrace of battery-electric cars and plug-in gasoline-electric cars. These vehicles together make up 40 percent of China’s car market, the world’s largest, and are expected to be more than half next year. Like most Chinese automakers, BYD doesn’t sell its cars in America because Trump-era tariffs remain in place, but BYD does sell buses in the United States.

The fact that BYD can succeed on that level globally while being effectively shut-out of the US market shows us … how less important the US market is in today’s globalization — i.e., relative demand as relative power. Again from my book:

Now, risen China’s auto industry balloons to three times our size, putting Beijing in the driver’s seat in an industry synonymous with American greatness. In 1960, the United States manufactured half the world’s motor vehicles; we now produce one-tenth of a global market five times larger in size.

Meeting the demand of a majority global middle class: that is how you build economic strength because that demand is in the driver’s seat. China is rushing to achieve that sort strength. America is busy guarding its domestic market.

Guess who wins over time.

8) A socialist state that fails on basic welfare

REUTERS: China's childcare costs among highest in world, think tank says

No mystery: if you want more babies, make it cost less to have them:

The cost of raising a child until they are 18 relative to per capita GDP is around 6.3 times in China versus 2.08 times in Australia, 2.24 times in France, 4.11 times in the U.S. and 4.26 times in Japan, said a report by the Beijing-based YuWa Population Research Institute.

This is a fundamental feature (not a bug) of modern urban life: kids go from asset to liability. So, either reduce the cost of that liability or get used to much lower fertility.

9) And the puppets shall lead

GUARDIAN: Herd of puppets to trek 20,000km to highlight urgency of climate crisis

A sort of activist art: giant puppets representing animals will trek around Africa and Europe, with much pomp and circumstance, to embody the threat to species posed by climate change: being put on the move.

The effort follows a similar effort with a giant girl puppet representing refugees put on the move by crises.

Good stuff.

10) And the baby doctors shall leave

BOISE STATE PUBLIC RADIO: New report shows 'dramatic exodus' of Idaho OBGYNs since repeal of Roe v. Wade

The unintended consequence of criminalizing pregnancy:

A new report shows Idaho has lost 22% of its OBGYNs since Roe v. Wade was overturned in 2022 – that’s more than 1 in 5.

“The net supply of obstetricians practicing obstetrics in Idaho went down between 40 and 60 doctors in the 15-month period between August 2022 and November 2023,” the report said, “from 268 to about 210 providers for ~962,000 Idaho women.”

In that time period, two OBGYNs moved to Idaho. The report also shows that half of Idaho’s 44 counties do not have practicing obstetricians.

There is no net win on fertility by banning abortion; the costs just balloon elsewhere.

11) China’s quantum grand strategy — opposed

NYT: Silicon Valley Venture Capitalists Are Breaking Up With China

The emerging reality:

U.S. venture capital firms that once saw China as the next frontier for innovation and investment returns are backing away, with some separating their Chinese operations from their American business and others declining to make new investments there.

The about-face stems from the tense relationship between the United States and China as they jockey for geopolitical, economic and technological primacy. The countries have engaged in a trade war amid a diplomatic rift, enacting tit-for-tat restrictions including U.S. moves to curb future investments in China and to scrutinize past investments in sensitive sectors.

Some in Congress are catching on to China’s “quantum grand strategy” as I call it: their push to capture citizens in other countries and enmeshing them within their cyber realms — starting with their smartphones.

Beijing’s practice of enlisting companies for its own purposes, like aiding in surveillance and modernizing its military, has created further challenges.

The model is coming increasingly into focus:

12) Home-shoring is the truest friend-shoring

FOREIGN AFFAIRS: The United States’ Missed Opportunity in Latin America

Shannon K. O’Neill, whose book I cited in ANM, repurposes her solid argument in Foreign Affairs (she is a CFRer).

You want to de-couple from a China you find more threatening or adversely competitive, so bring it home, she says, versus keeping those chains long by going only with military allies — like South Korea:

These far-flung efforts, however, badly neglect solutions in the United States’ own backyard: the countries of Latin America. The region is rich in the critical minerals the United States needs. Many Latin American countries already boast sophisticated pharmaceutical industries. Others have technically sophisticated, economically competitive, and geographically proximate workforces that could assemble, test, and package microchips made in U.S.-based fabrication plants. American car makers already rely on Mexico, and incorporating Latin America more fully into electric vehicle manufacturing would make the industry more competitive by drawing on different labor markets and tapping into a fuller range of subsidies provided by the Inflation Reduction Act.

U.S. leaders consistently overrate the worth of securing alliances next door to China and overestimate Europe’s commercial prospects …

In terms of geographical proximity, Latin America, by contrast, is a Goldilocks option for U.S. manufacturers. It is not so close to the United States that moving production there would dangerously concentrate risk from natural or manmade disasters, but it is not so far that it creates complicated long-distance logistics problems. The United States has a great deal to gain broadly from helping Latin American countries strengthen their economies. Most of those countries are democracies, and economic growth and democratic consolidation in the region would create new investment opportunities and middle-class consumers for U.S. companies. And Latin America is the one region in the world with which the United States has an existing trade and market advantage, having already inked free trade agreements with 11 countries there.

Yet the United States is failing to engage Latin America’s nations commercially or strategically, missing an opportunity to shore up national security and wasting built-in geopolitical advantages. Indeed, the United States cannot afford to overlook the opportunities Latin America offers. China already recognizes Latin America’s potential. It is swooping in fast, expanding its trade with the region from $12 billion in 2000 to nearly $500 billion in 2022. Its mining and refining companies are moving to lock up access to the region’s natural resources.

Great summation. Couldn’t agree more.

My argument is simply a geostrategic cut above that, citing climate change, demographic disparities, and the rise of a global majority middle class are combining to turbo-charge the logic of such North-South integration in the Western Hemisphere.