Trump 2.0 jumps the shark

MAGA has found its Moby Dick in the shipbuilding industry, and it's a whopper

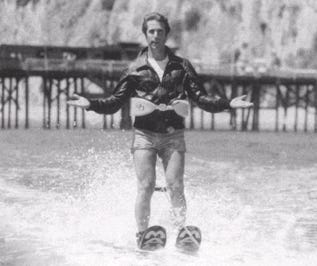

The idiom "jumping the shark" or to "jump the shark" means that a creative work or entity has evolved and reached a point in which it has exhausted its core intent and is introducing new ideas that are discordant with or an extreme exaggeration (caricature) of its original theme or purpose. The phrase was coined in 1985 by radio personality Jon Hein in response to a 1977 episode from the fifth season of the American sitcom Happy Days, in which the character of Fonzie (Henry Winkler) jumps over a live shark while on water-skis. [from Wikipedia entry on same]

Up to now, by my reading, Trump 2.0’s efforts on trade were broadly tariff-driven and designed to force both American firms and foreign firms to manufacture and sell in the US versus avail themselves of far more efficient global supply chains. By artificially raising the cost of everything imported (finished goods and even parts), these firms would be forced to protect their market shares here by knuckling under to this Made in America demand.

Not crazy but really hard.

Strictly as a negotiating tactic? Believable, if dangerous, but not crazy — unless you’re an economist and pretend to know better with your alternative facts.

But since the experts and globalists created this mess out of thin air, such means are necessary — or so we are told. Near-term pain swapped for a re-industrialization of the US that seems part-Stalinist in its ambitions (We have a four-year plan!), part-Maoist in its wacky sidetones (How about everyone start keeping chickens in their backyards and prosuming their own eggs?), and part-North Korean in its self-reliance vibe (it seems crazy to invoke the term autarky and yet that is what is often seriously described as the general goal).

au·tar·ky

/ˈôˌtärkē/

noun

economic independence or self-sufficiency.

"rural community autarchy is a Utopian dream"

a country, state, or society which is economically independent.

plural noun: autarkies; plural noun: autarchies

And yet, none of these dreams compare to the one currently being contemplated by some special shipbuilding office in the White House.

You know, MAGA experts.

The excellent WAPO story on this vision-beyond-visions is a stunner.

WAPO: Trump wants to build more ships in the United States. It’s not so simple.; The administration aims to counter China’s dominance of commercial shipbuilding.

I don’t know which is more fantastic — the goal or the means, but the combination is jaw-dropping in its assumptions.

President Donald Trump appears set to broaden his attack on global economic integration by imposing new multimillion-dollar fees on the Chinese container ships that bring many foreign goods to U.S. shores.

You have my attention on this point alone, because even a non-economist like me can spot all sorts of trouble here as the world’s shipping industry counter-responds in ways that punish the US economy.

But that’s just me with yea-much knowledge (my force planning days with the Department of the Navy are three decades past). How about an industry expert on the proposed plan, if you can stomach one:

“It appears to be written by people who have absolutely no idea how the maritime supply chain works,” said Lars Jensen, chief executive of Vespucci Maritime, a consultancy in Copenhagen. “The container lines will adjust and cut out the smaller ports. The consequence is going to be massive port congestion in the larger ports.”

So, we inadvertently create a COVID-like jam-up of ports because, last time that happened, it triggered a lengthy and nasty bout of inflation coupled with shortages.

The hammer here is a bill we present to any ship built or operated by the Chinese for accessing our ports — up to $3.5m per stop.

Will that get Beijing’s attention? Yes it will.

Will it damage their shipbuilding industry/advantage? Let me count the years it would take to pull that off, because we’re talking several potential change elections in the US over the same timeframe.

The concept here is — again — jaw dropping in its economic naïveté:

By charging Chinese-owned or -built vessels each time they dock at a U.S. port, the administration hopes to discourage ocean carriers from buying more ships from China. The U.S. government would spend some of the tens of billions of dollars raised through the fees on subsidizing a commercial shipbuilding industry that has fallen into disrepair.

Generous government support, including tax incentives, would enable revitalized U.S. shipyards to fill orders that now go to facilities in China, South Korea or Japan, according to the administration. U.S. exporters also would be required to meet targets for shipping their goods on U.S.-flagged vessels, rising from almost nothing to 15 percent of the total in seven years.

Wow and wow. Now we’re talking deep into the Vance Administration.

Feel back-to-the-future in its ambitions? It most certainly is:

In a speech Tuesday, Vice President JD Vance cited the nation’s shipbuilding decline as an example of deindustrialization that “poses risks both to our national security and our workforce.” Vance contrasted the industry’s performance during World War II, when shipyards turned out “three ships every two days,” with its current annual output of just five ships.

We should have the same grand strategic ambitions and assets as we did 80 years ago because nothing really has changed in global economics in the meantime.

I mean … nothing that would make this vision impossible to achieve, am I right?

The timeline to achieve this? No big whoop:

“We used to make so many ships. We don’t make them anymore very much, but we’re going to make them very fast, very soon,” Trump said in his address on March 4 to a joint session of Congress.

The power of positive speeching.

As for the impact, it will be immediate, if this is actually set in motion:

Such upheaval in shipping schedules would have consequences for large and small ports. Container ships normally operate like waterborne buses, making scheduled stops at multiple ports along a coastline.

I see.

But facing fees that might reach $3.5 million for each stop, they would probably choose to unload all of their cargo in just one place, such as the Port of Los Angeles, executives said.

Ooh! That does sound likely.

“You are absolutely going to disrupt the U.S. economy. You’ll create covid-like congestion at places like L.A., Long Beach and New York,” said Joe Kramek, president of the World Shipping Council, which represents the major ocean carriers.

Libtard worry-wart!

Fewer vessels docking at smaller ports such as Oakland, California, would make it harder and more expensive for major U.S. exporters to ship their goods to foreign customers, and it would affect imports as well. Farmers who rely on bulk carriers to move grain and other commodities would be hit especially hard, forced to send their crops hundreds of miles overland to Southern California.

The farmers will suck it up and/or the USG will send them billions to cover the loss.

The proposed fees “will have catastrophic effects on U.S. exports,” Kevin LaGraize Jr., president of Southport Agencies in Metairie, Louisiana, said in written comments submitted to USTR.

Again, where do they find these so-called experts? I mean, other than in industry associations?

Sound scary? It is. It’s almost like Trump 2.0 wants to recreate the supply-chain disruption suffered by late Trump 1.0, thanks to the pandemic.

To me, that has a certain death-wish vibe to it that puts the underlying nihilism of all these Big Bang moves into stark relief: the casual courting of extreme outcomes in order to resurrect the idealized past, the scary catch being: Even if we totally fail, we’ll at least have destroyed the path we’re on.

To me, that is doom-seeking of the highest order. But the MAGA faithful are getting off on it (for now), so I say, bill baby bill! Daddy needs a new pair of US-made shoes!

I mean, why not go back even farther in US economic history and regain our dominance in beaver pelt exports! We could bring back mens hats!

WAPO tracking some of these fears and ambitions back to the Biden Administration is certainly good reporting, and, what the hell, let’s embrace this impossible dream in a bipartisan manner because we imagine suddenly revived steel and shipbuilding industries creating a new manufacturing golden age (covered by a Golden Dome, no less).

Let’s also trace this logic back to national security and the notion that China will rule the seas because it has more (in-number-but-far-less-capable) naval vessels than we do.

I mean, how long has it been since we’ve witnessed a major sea battle between great powers where force attrition determined the winner?

Hmmm.

Processing …

How about 1944’s Battle of Leyte Gulf?

Since then … nada to suggest that either a great naval war of attrition or that a supreme naval engagement is going to determine the outcome of some war … unless … you fantasize, as the Pentagon has for years now, about a drawn-out naval-centric fight between American and China over Taiwan.

But wait a tick? Isn’t that fight now slated to be some sort of “drone hellscape” that renders all their naval assets just these big fat targets for swarm attacks?

Not ours, mind you — just theirs.

Okay, smart ass, how about the Houthis and the Red Sea shooting match between our naval vessels and … you know … those guys on shore?

Yes, those Red Sea ops do constitute the biggest deployment of US naval firepower in decades.

As for the state of the Houthi navy? There is none. So, what we have here (besides a failure to communicate) is a conventional naval force taking on a drone force at a very lopsided — dare I say, unsustainable — spending rate.

[Jump cut to close-up of jut-jawed US admiral staring through his binoculars on board the carrier, intoning menacingly: We can do this all day, muchachos! {Then, breaking the Fourth Wall with a guilty smirk} We just can’t afford it!]

To me, there’s your future of military combat — asymmetrical in the extreme, overwhelmingly unmanned.

Would the vaunted Chinese navy perform any better against the Houthis, if given the chance? I don’t see how. So, I’m not seeing the great future naval-ship-gap with the PLA Navy that necessitates our addressing the great present commercial-ship-gap — much less the underlying Chinese dominance of the shipbuilding industry.

This all feels like going backwards just as the Military Singularity arrives.

We could tilt at this windmill for decades, but let’s be real about likely outcomes on a timeline the US economy could endure:

Maritime specialists call hopes for a Lazarus-like revival of U.S. shipbuilding unrealistic, saying it would require decades of consistent federal support. Imposing hefty fees on Chinese ships now, before American-made alternatives exist, would only raise freight costs and snarl global supply chains, they said.

The irony — again — here is that… I run out of superlatives: America self-inflicts a pandemic-like effect on shipping into US ports.

You can’t make this stuff up and yet it’s actually happening all around you.

Keep reading with a 7-day free trial

Subscribe to Thomas P.M. Barnett’s Global Throughlines to keep reading this post and get 7 days of free access to the full post archives.