Correlation versus causality

Spotting geopolitics where it might just be logical economics

[Note to all our new subscribers from the Dairy Board Association’s Dairy Strong conference yesterday in Green Bay: I publish a post every day of the week. Most of my posts (all workweek ones) have the majority of their content behind the paywall (you’ll get a preview in our email to you), but every Sunday post (the biggest one reviewing the week’s news as I track it) is free, as are, occasionally, the Saturday ones. Naturally, I hope you find the analysis of enough value to subscribe at either $5/week or $50/year. As I post 365 days/yr, your cost comes out to <20 cents/post.

Anyway, this post is free to all as a thank-you for all your signups.]

As a kid growing up in the late 1960s, the Chinese leadership was constantly calling America names and daring us to start a nuclear war with them.

Recently, the Chinese foreign minister argued that ““It can be said that China-United States cooperation is no longer a dispensable choice for the two countries or even for the world, but a mandatory question that must be seriously addressed.”

Not exactly the crazy, belligerent propaganda I remember oh so well (being myself a Capitalist Running Dog!)

Why to remember: Geopolitical tensions between the US and China are above average right now. Not crazy and out-of-control as some of the most vocal fear-mongers would have you believe, but definitely above average.

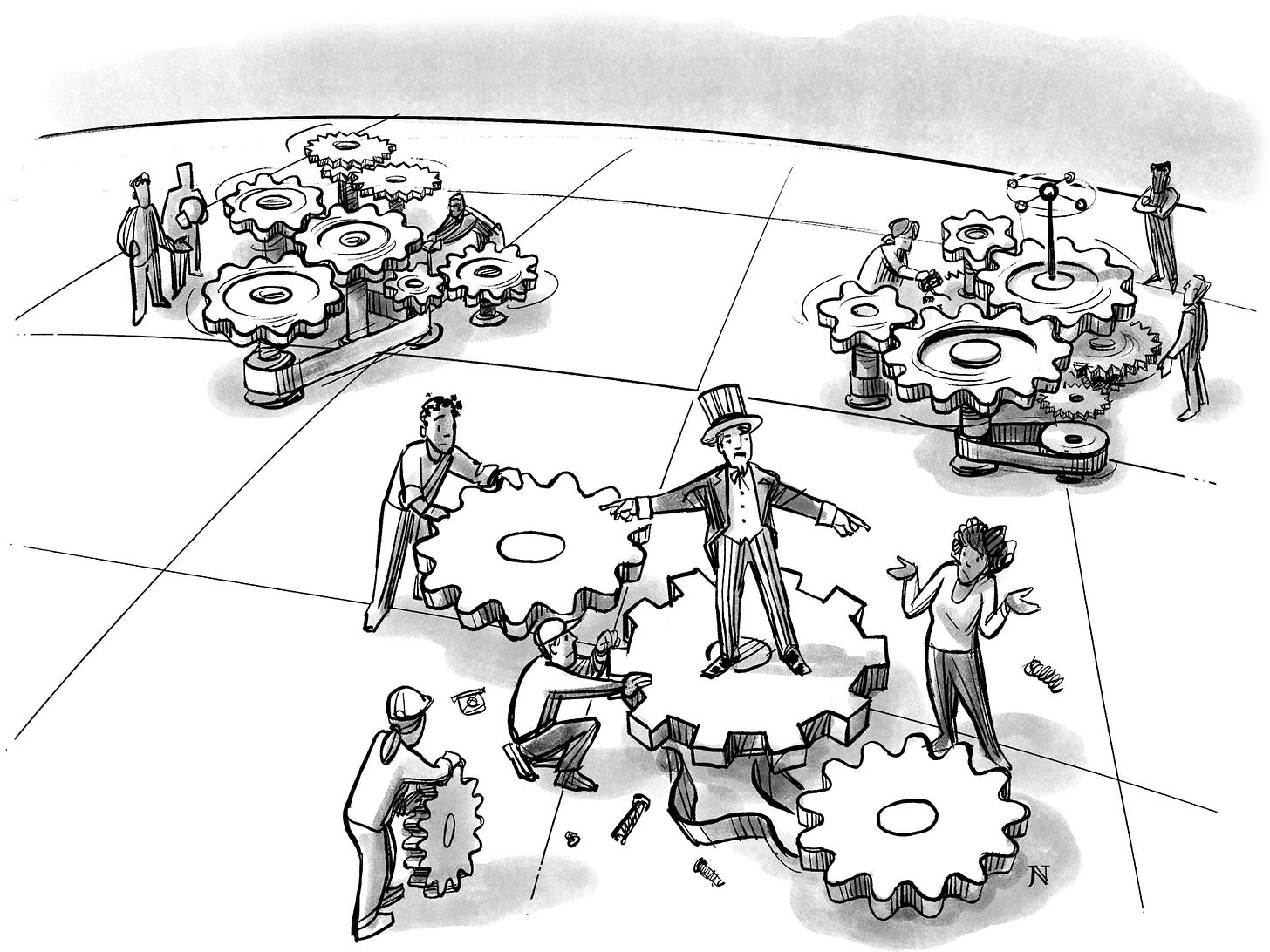

Clearly, then, this above-average tension is why Chinese exports to the US are down while Indian exports to the US are booming. Might we call this an Asian pivot?

This is also why Mexico regained the top spot as #1 exporter to the US, the fact that we’re contiguous neighbors simply reflected the “friend-shoring” impulse that mirrors our “de-risking” dynamic with China. Clearly, these are geopolitical impulses being felt throughout the business world, determining the shifting shape of global trade.

I mean, we all know that political leaders control economic outcomes, right? POTUS determines the price of gas and the unemployment rate, so, if either are off, then POTUS got to go! Because new POTUS will fix things old POTUS screwed up.

This is Economics 101. I should not have to explain this. As the Dothraki like to say, It is known.

More proof: SE Asia replacing the US as prime export destination for China.

I mean, with all that geopolitical bullying by China of its neighbors, it only makes sense that Beijing directs more exports to SEAsia than North America. It might seem counter-intuitive, but it really isn’t.

Then again, maybe this is all correlation masquerading as causality.

From America’s New Map:

When Asia emerged as globalization’s “factory floor” across the 1980s, 1990s, and 2000s, intercontinental supply chains (often called global value chains) arose to take advantage of the extreme wage differential that Asia— and particularly China—offered. That wage differential dissipated, along with China’s demographic dividend, around the time of the Great Recession, thus flatlining globalization’s advance in terms of goods manufactured across truly global value chains. Now, with China consuming far more of its own production, it anchors an increasingly regionalized Asia manufacturing hub—much like the EU. This is how the two regions came to generate two-thirds of the world’s GDP today while America’s share slid from 30 percent in 2000 to 24 percent in 2021.

Maybe this is why China relies less on exporting to the United States.

Maybe it has less to do with our fears than with China’s logical regional ambitions:

China’s economic maturation has put it on par with advanced economies regarding trade dependency—the essence of any nation’s relationship with, or subjugation to, globalization. The EU, for example, conducts two-thirds of its trade within its union, leaving only one-third exposed to external forces. America’s inter- and intrastate trade accounts for three-quarters of its GDP, leaving a mere quarter exposed to global trade. In the early 2000s, China depended on foreign trade for two-thirds of its GDP. Today that share sits at one-third, meaning Beijing can now plan for a globalization that increasingly adjusts its value chains to revolve around China’s demand signal.

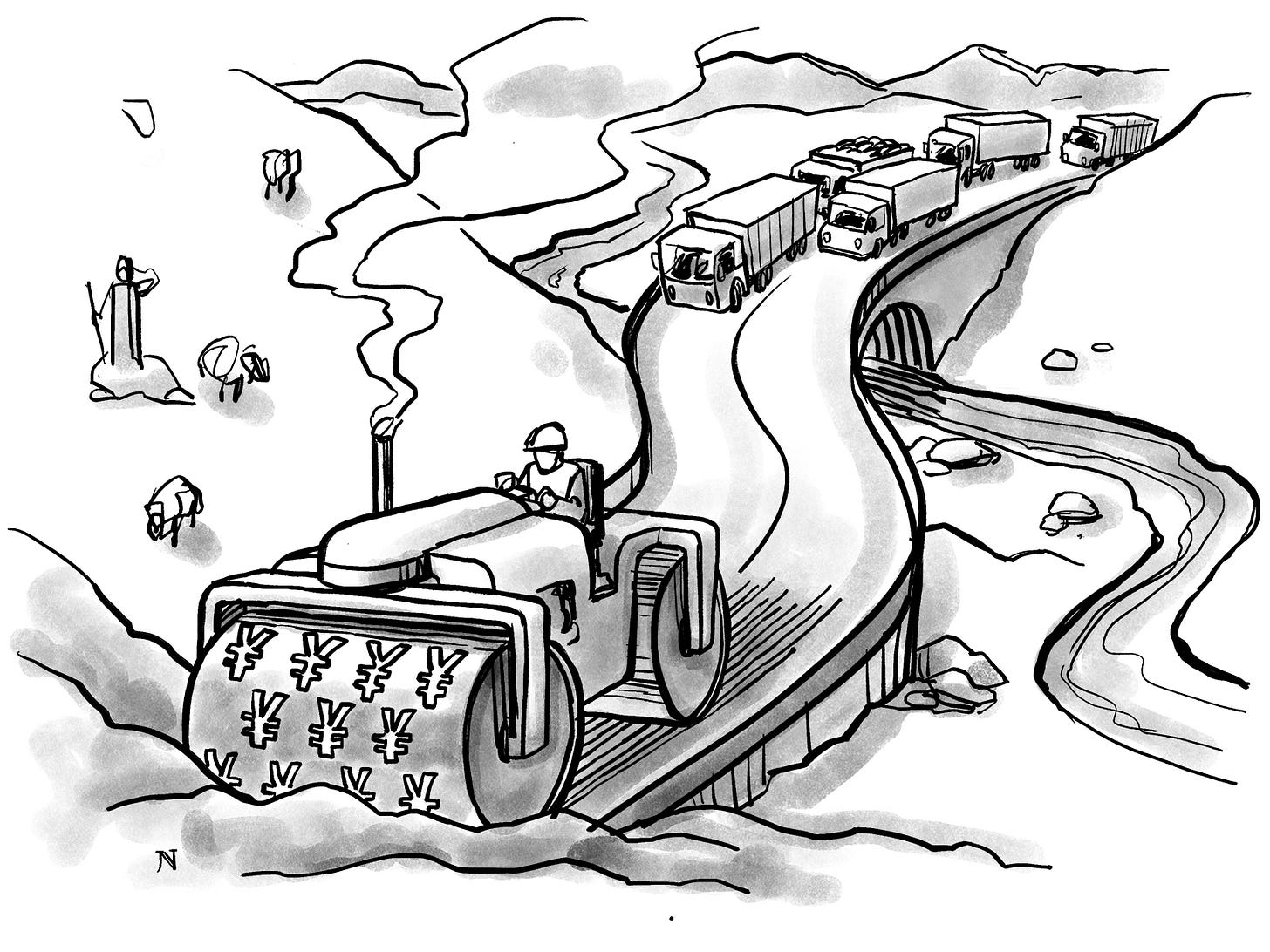

Maybe this is why China now concentrates its exports on SEAsia, which, BTW, is the prime global region enjoying a demographic dividend right now:

China’s own demographic dividend (1980–2010) followed closely on Japan’s heels, only to peak during the Great Recession. Not only have factory wages risen ever since but now Beijing also faces a loss of 200 million workers by 2050.

Fortunately for China, globalization’s next great pool of cheap labor emerged next door in Southeast Asia, to which Beijing is already directing its lower-end manufacturing assets and investments in increasing competition with Japan and India. But Southeast Asia’s own rapid aging is well underway, compressing its demographic margins and marking it as mere placeholder for its far-larger successor: India, with its youth bulge of half a billion souls.

Maybe India, on the cusp of its own demographic dividend, is enjoying increased exports — particularly in electronics — because that’s a leading indicator of a rising manufacturing power stepping up to cash in that dividend. Didn’t cheap Japanese electronics presage Japan’s rise. Did we not seem the same with cheap Chinese electronics at a certain point. Are we possibly just seeing the same dynamic repeated with India, which recently replaced China as number-one external supplier to America’s Walmarts?

Or is it all geopolitics? Do you think Walmart got the presidential directive? I mean, Walmart is known for taking tough geopolitical stances, sacrificing profits as need be.

More from the book:

The economic drivers behind globalization’s transformation from goods-centric to service-centric make clear that we are in a period of globalization’s intraregional consolidation. The driver here is China, where skyrocketing consumption captures more of what its domestic economy produces, leaving less for export. This is becoming true of many emerging markets, where domestic and regional supply chains rapidly expand to meet middle-class demand that is increasingly addressed with just-in-time delivery mandating the nearshoring of certain segments. As (Anything)-as-a-Service business models proliferate, the line between goods and services blurs, while the latter’s role in global value chains expands, likewise favoring shorter, more intraregional networks that improve speed-to-market timelines.

Could this economic logic actually explain more than the proposed geopolitical strategy of “friend shoring”? Could corporations be working their bottom lines more than addressing “rising geopolitical tensions”?

Add it all up:

Point being all these consolidating trends are a logical, system-wide response to the emergence of a global middle class located overwhelmingly in emerging markets, which, until recently, lacked the infrastructure—both physical and virtual—for these levels of consumption. No economic law states value chains must always be world-spanning to constitute “real” globalization. If anything, business logic argues for supply chains to be no longer than necessary to efficiently serve any market. That is the “de-globalization” we witness today: the emergence of more efficiently regionalized value chains to serve new demand centers—China chief among them.

Many Americans still live with the delusion that we run things globally — that globalization is something our devious, baby-eating, Satan-worshipping elite “globalists” manage from on high. We fantasize that our geopolitical strategies shape global economics more than the other way around. We cling to the notion that we still have our hands on globalization’s wheel, when the integrator of note in the system has been China for years now with its Belt and Road Initiative and world-spanning efforts at achieving network centrality on 5G and what follows that (Internet of Things, AI of Things, etc.). Eventually, India will eclipse China in this integrating role, and we will somehow come to demonize India in response to this magnificent achievement.

We need to put aside these childish things, and these immature concepts.

Globalization is not zero-sum. China does not have to lose for America to win. Nor does China have to lose for India to rise.

Globalization comes with rules, not a ruler. Those rules are under constant attempted revision by rising economic pillars.

These are not realities to be wished away but to be conceded, stipulated, accepted.

There are many solid reasons for the US to concentrate on regional trade and investment integration — not just across North America but across Central and South America and the Caribbean too. We should do so not out of fear of rising/risen Asia but because it makes economic sense — particularly as climate change unfolds and stresses out the world along North-South lines.

A horizontal world made vertical.

Correlation is not causality.

Causality is causality.

Embrace that reality and this all becomes so much easier to imagine and carry out.

The narrative on supply chains needs to be challenged a bit, primarily on technicalities.

Mexico might now be the US’ #1 exporter, but a significant part of the background involves the volume of re-exports of what Mexico imports from other parts of the world. In another case, China is exporting at a net increase to SE Asia, but how much volume is intended for free circulation, and how much volume is transiting (where local ordinance may allow for re-packing), versus being purely re-exported to Mexico?

It is known that Chinese intermediate goods are re-exported from Mexico to the United States after final assembly in Mexico. This may even include some “assembly” in SE Asia to qualify for rules of origin.